Big Drop in Battery Demand May Hurt Makers Like CATL and EVE Energy

China’s lithium battery industry is bracing for a potential slowdown in early 2026, a development that could have wider implications for the global electric vehicle (EV) ecosystem, including India. According to the China Passenger Car Association, demand for lithium batteries is expected to decline sharply due to weakening domestic EV sales and slower export growth.

Cui Dongshu, Secretary General of the association, warned that demand for new energy batteries may drop drastically from the end of 2025, urging battery manufacturers to cut production and prepare for market fluctuations. China, which is the world’s largest producer and exporter of lithium batteries, has so far benefited from strong global demand driven by EV adoption and energy storage needs.

China EV Battery Prices Rebound as Raw Material Costs Surge; Modest Rise Expected in 2026

However, the anticipated demand slump is expected to hit major battery makers such as CATL and EVE Energy, which play a critical role in global EV supply chains. Cui noted that sales of green passenger vehicles in China could fall by at least 30% in early 2026, primarily due to the gradual withdrawal of tax incentives and purchase subsidies.

Commercial electric vehicles are also likely to see a sharp decline, as buyers rushed to complete purchases before subsidy deadlines. Cui added that the loss in domestic demand is unlikely to be compensated by exports, raising concerns for manufacturers dependent on overseas markets.

Export data highlights the challenge. China’s lithium battery exports to the European Union rose modestly by 4% in 2025, while shipments to the United States fell by 9.5% year-on-year. This decline suggests that rising US demand for energy storage—driven partly by the artificial intelligence boom—has not translated into higher demand for Chinese batteries.

Adding to the uncertainty, UBS analysts have flagged risks from stricter US policies, particularly restrictions on projects involving “foreign entities of concern” that seek investment tax credits.

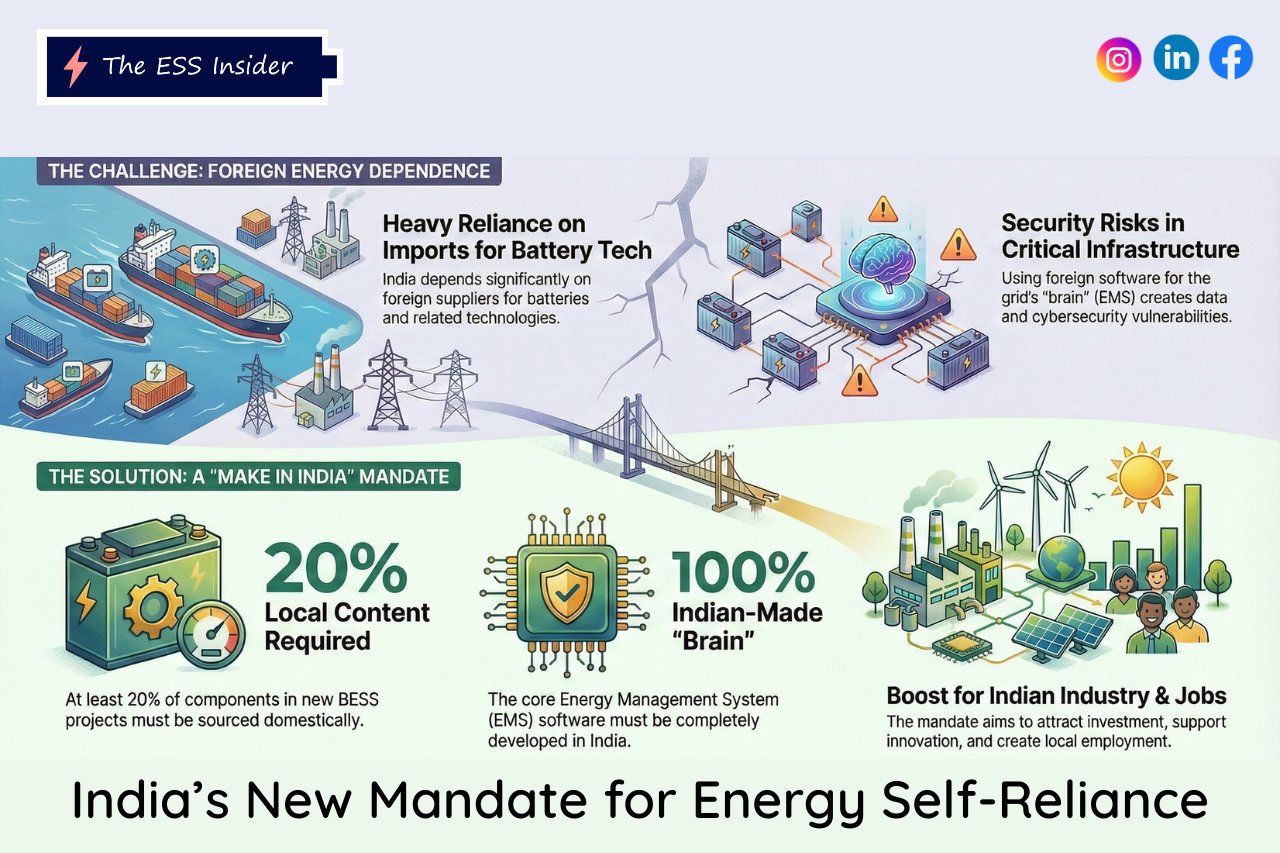

For India’s EV sector, any prolonged slowdown in China’s battery industry could influence global pricing, supply availability, and diversification strategies, underlining the importance of strengthening domestic battery manufacturing and alternative supply chains.

Comment by Author:

China’s projected lithium battery demand slump in early 2026 serves as a timely warning for the global EV ecosystem. As the world’s largest battery producer recalibrates output, ripple effects on pricing, supply stability, and export flows are inevitable. For India, this moment underscores the urgency of accelerating domestic battery manufacturing, securing diversified supply chains, and reducing overdependence on a single geography. A strategic push toward local cell production and alternative sourcing could turn this global slowdown into an opportunity for India’s rapidly expanding EV market.

Click here for more such EV Updates