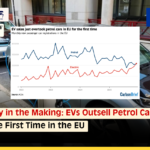

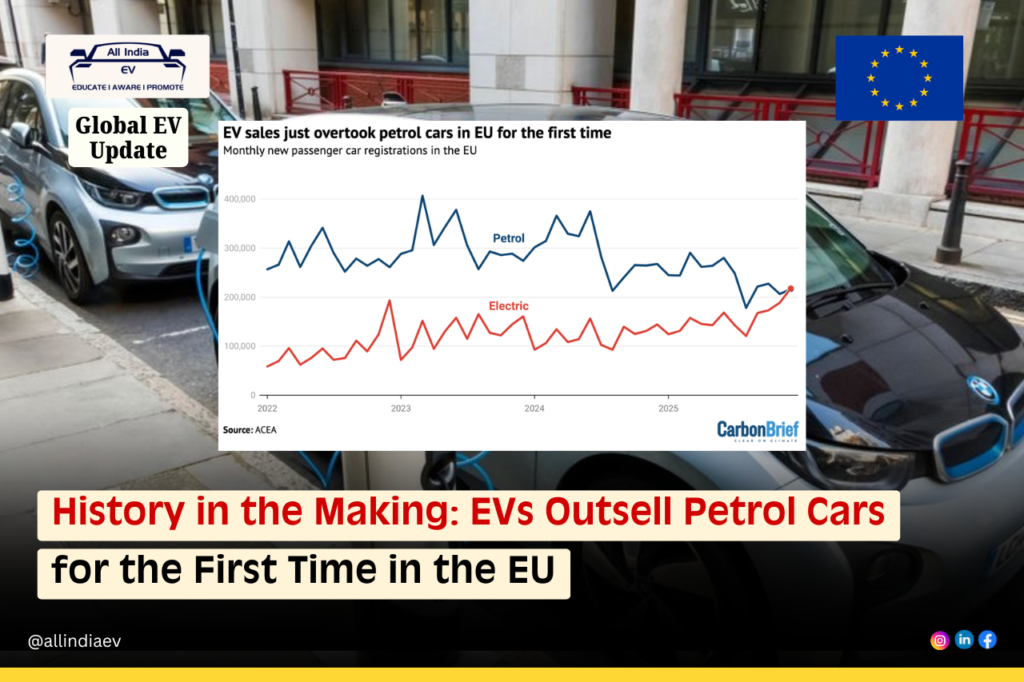

In December 2025, EU EV registrations hit 217,898, surpassing petrol cars for the first time, as global EV sales rose 20% to 20.7 million.

In a landmark moment for the global automotive industry, fully electric cars have outpaced petrol-powered vehicles in sales across the European Union (EU) for the first time on record. Data released this month shows that in December 2025, electric vehicle (EV) registrations narrowly exceeded those of traditional petrol-only cars, marking a turning point in consumer demand and the region’s broader shift toward cleaner transportation.

According to figures compiled by the European Automobile Manufacturers’ Association (ACEA), 217,898 battery-electric vehicles were registered in the EU in December, compared with 216,492 petrol cars, putting EVs marginally ahead in sales for the month. This outcome represents the first time electric cars have overtaken petrol vehicles in European monthly sales history a milestone long anticipated by industry analysts.

A Milestone Month for EV Adoption

December 2025’s numbers illustrate a rapid rise in electric car adoption and a concurrent decline in petrol vehicle registrations. Fully electric cars experienced a year-on-year surge of roughly 50 percent in December sales, while petrol car registrations fell nearly 20 percent compared with the previous year.

Experts note that this breakthrough reflects not just seasonal fluctuations, but broader shifts in consumer behaviour, manufacturing focus, and regulatory frameworks across the EU. While petrol and diesel vehicles have dominated for over a century, electrification has steadily gained ground owing to improvements in technology, expanding model ranges, and broader policy support.

European Market Growth and Global Context

The EU’s milestone echoes a broader global trend: electric vehicle sales increased sharply in 2025, reaching an estimated 20.7 million units worldwide about 20 percent more than in 2024. Europe itself logged robust growth, with countries such as Germany, the UK, France, and the Netherlands leading EV adoption.

This surge helped the continent outpace other major regions in terms of growth percentage, even as North American EV sales showed more modest increases. China remains the world’s largest electric car market by volume, but Europe’s growth rate underscores the region’s accelerating transition to electric mobility.

Industry Leaders and Competition

Traditional European automakers including Volkswagen, Stellantis, Renault, BMW, and Hyundai have significantly expanded their electric offerings, helping boost EV registrations across the bloc. Meanwhile, Chinese brands such as BYD have rapidly increased their footprint in Europe, tripling their market share in some segments and intensifying competition.

Tesla, once synonymous with electric vehicles in Europe, experienced a decline in market share in 2025, in contrast with several legacy and new EV makers that expanded their portfolios more aggressively.

Policy Shifts and Regulatory Uncertainty

This historic achievement arrives amid ongoing debates around EU emissions policies. While previously the bloc had championed an outright ban on sales of new petrol and diesel cars by 2035, proposals in late 2025 suggested shifting to a target focusing on a 90 percent reduction in carbon emissions instead of a full ban, potentially allowing some continued sales of combustion vehicles under stringent sustainability requirements.

Despite regulatory uncertainties, industry analysts emphasize that consumer demand for electric vehicles is outpacing policy shifts, driven by expanding charging infrastructure, competitive pricing, and increased consumer choice. Many EU member nations are also offering targeted incentives and subsidies to support EV uptake, particularly for middle- and lower-income buyers.

Broader Market Trends and Future Outlook

While December’s results are significant, it’s important to contextualize them within broader annual trends. For all of 2025, petrol cars still held a larger share of total new sales compared with purely electric vehicles, though hybrid and plug-in hybrid models continue to grow in popularity, collectively holding a major share of the overall market.

That said, most industry observers view December’s milestone as a clear indicator of rising electrification momentum. Forecasts suggest that as technology improves and costs decline, battery-electric vehicles will continue to take a larger proportion of new sales in 2026 and beyond. Automakers are expanding EV production capacity, while investment in battery supply chains and charging infrastructure continues to accelerate.

Environmental and Economic Implications

The shift toward electric vehicles carries significant implications for Europe’s environmental goals. Greater EV adoption is expected to contribute to reducing greenhouse gas emissions from transportation one of the hardest-to-decarbonize sectors and decrease dependence on imported fossil fuels. However, experts caution that the environmental benefits depend on the widespread use of renewable energy sources to power EVs and robust recycling systems for batteries.

Economically, the transition presents opportunities and challenges. Europe’s automotive industry must navigate a complex landscape of global competition, supply chain realignment, and evolving consumer expectations all while ensuring jobs and manufacturing activity remain strong.

December 2025’s EV sales figures mark a watershed moment for the European automotive market. Electric vehicles have, for the first time, overtaken petrol cars in monthly sales signaling both the scale of electrification progress and the potential for even more dramatic shifts in the years to come.