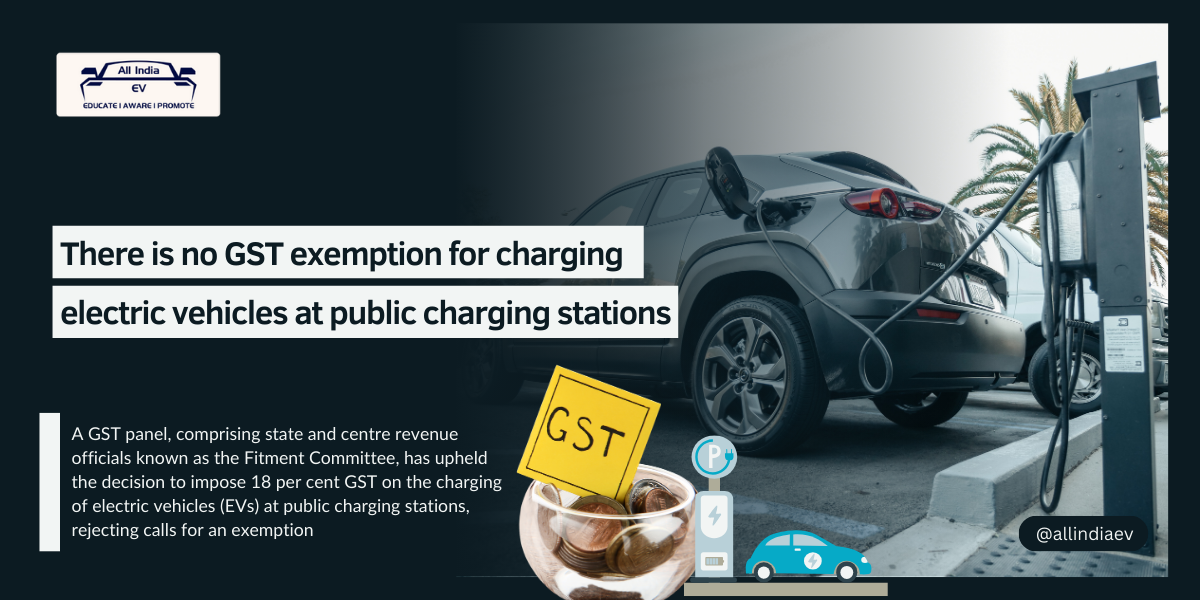

Government Imposes GST on Electric Vehicle Charging

The Ministry of Power has earlier said that charging of an electric vehicle is a service and not sale of electricity. A GST panel, made up of state and central tax officials, has upheld the decision to impose an 18% GST on charging electric vehicles at public stations. The panel rejected industry pleas for a tax break, arguing that charging EVs involves both electricity usage and additional station fees.

EV Charging Gets Zapped: GST Clarification

While the supply of electricity as such is exempt from the levy of GST, AAR, Karnataka, has held that the charging of an electric vehicle at public charging stations is a service that is liable to taxation. The AAR said the charging stations provide for facilities and services in addition to the electricity that justifies an 18% GST. The ruling has strong implications for the fast-expanding ecosystem of electric vehicles and charging infrastructure that is coming up.

The broader implication of this ruling by AAR is the complexity of determining the taxable nature of services amidst the emergence of new technologies. While electric vehicles are finding greater acceptance day by day, it is considered important that guiding principles and regulations must be in place for the right ecosystem to continue their growth in years to come.

EV Charging Tax Stays: A Clarification

The Ministry of Power has clarified that the process for charging an electric vehicle is a service and not a sale of electricity. That was important to keep the current 18% GST on the charging of EVs at public charging stations going.

On the strength of this judgment, therefore, EV users will continue paying the same tax on the total amount charged. This judgment gives clarity to the developing market for EVs and ensures the same regime of taxation for EV charging services.