India’s EV voltage shift in 2025: Comparing 400V vs 800V systems to understand performance, efficiency, and what it means for the future of electric vehicles.

India’s electric vehicle (EV) market is on a steep growth trajectory, projected to reach USD 69.22 billion by 2033 from USD 12.09 billion in 2024 (Indian Electric Vehicles Market Size). Amid this expansion, a critical technical evolution is underway: the transition from 400V to 800V electrical architectures. This shift, often dubbed the “voltage war,” is reshaping how EVs are designed, charged, and adopted in India. In 2025, while 400V systems remain the backbone of the market, 800V architectures are emerging in premium segments, driven by global trends and local ambitions. This analysis explores the current state, emerging models, manufacturer strategies, and challenges shaping India’s voltage landscape.

Understanding Voltage Architectures

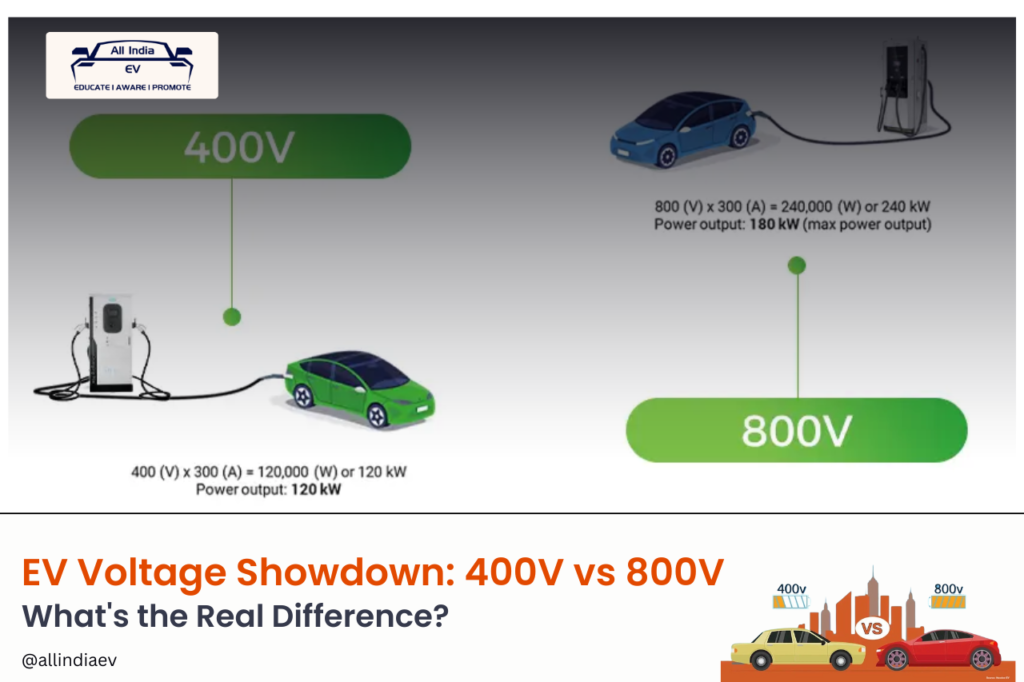

The voltage architecture of an EV governs the electrical system that powers the battery, motor, and other components. It directly impacts charging speed, efficiency, and vehicle performance. The two primary architectures are:

- 400V Architecture: The industry standard for most EVs, operating at around 400 volts. It is cost-effective, widely supported by existing charging infrastructure, and ideal for mass-market adoption. However, higher current requirements can lead to heat generation, slower charging, and heavier cables (400V vs 800V Charging).

- 800V Architecture: A newer system that doubles the voltage, reducing current for the same power output. This enables faster charging, lower heat losses, and lighter components, enhancing efficiency and performance. However, it comes with higher initial costs and requires specialized infrastructure (800V Charging vs 400V).

In India, where affordability and infrastructure are key considerations, the choice between these architectures is a strategic one, balancing cost, performance, and scalability.

Current State of India’s EV Market

As of 2025, India’s EV market is predominantly built on 400V architecture, reflecting the country’s focus on affordable and accessible electric mobility. Popular models include:

- Tata Nexon EV: A market leader, using a 400V system with a range of over 300 km and charging times suitable for urban use (Tata Nexon.ev 2025).

- Mahindra XUV400 EV: Another 400V model, competing in the compact SUV segment with competitive pricing (Mahindra XUV400 EV).

- MG ZS EV: A 400V-based SUV offering a balance of range and affordability (MG ZS EV).

- Kia EV3: Set to launch in India in 2025, this compact SUV uses a 400V architecture, achieving a 10-80% charge in 31 minutes and a range of up to 600 km (WLTP) (Kia EV3 India Launch).

- BMW iX: Available in India, this luxury SUV relies on a 400V system, delivering up to 324 miles of range but with slower charging compared to 800V models (2025 BMW iX Review).

The prevalence of 400V is driven by its lower manufacturing costs, established supply chain, and compatibility with India’s 12,146 public charging stations as of February 2024, most of which support 400V systems (Electric Vehicle Industry in India).

Advantages of 400V Systems

- Cost-Effectiveness: Lower component costs make 400V EVs more affordable, crucial for India’s price-sensitive market (Know Your EV: 400V vs 800V).

- Infrastructure Compatibility: The existing charging network supports 400V, ensuring accessibility for consumers.

- Proven Technology: A mature ecosystem reduces risks for manufacturers and consumers.

Limitations of 400V Systems

- Slower Charging: Typically limited to 150-250 kW, resulting in longer charging times (Is an 800V EV Necessary?).

- Efficiency Losses: Higher current generates more heat, requiring thicker cables and reducing efficiency.

- Future Constraints: As demand for faster charging grows, 400V may struggle to meet expectations for long-distance travel.

Emergence of 800V Architecture in India

While 400V dominates, 800V architecture is making inroads, particularly in premium and high-performance EVs launching in 2025. Two notable models are:

- Audi Q6 e-tron: Expected in India in May 2025, this SUV is built on the Premium Platform Electric (PPE) with an 800V architecture. It supports up to 270 kW charging, adding 255 km of range in 10 minutes and achieving a 10-80% charge in 21 minutes. Its bank charging feature allows compatibility with 400V stations by splitting the battery into two 135 kW halves (Audi Q6 e-tron Battery).

- Mercedes-Benz CLA Electric: Set for an August 2025 launch, this compact sedan uses an 800V architecture based on the Modular Architecture (MMA) platform. It offers a 492-mile (WLTP) range and can add 186 miles in 10 minutes at up to 320 kW (Mercedes-Benz CLA Electric).

These models highlight the growing appeal of 800V systems for consumers seeking faster charging and premium performance, particularly for intercity travel and luxury segments.

Advantages of 800V Systems

- Ultra-Fast Charging: Reduces charging times significantly, enhancing convenience (What is 800V Electric Vehicle?).

- Enhanced Efficiency: Lower current reduces heat and energy losses, improving range and battery longevity.

- Lighter Components: Thinner cables and smaller electronics reduce vehicle weight, boosting dynamics (800V EVs: Should Automakers Adopt?).

Trade-offs

- Higher Costs: Advanced components increase production costs, potentially limiting affordability (High Voltage Vehicles).

- Infrastructure Gaps: India’s charging network is not yet fully equipped for 800V, requiring significant investment.

- Supply Chain Challenges: Transitioning to 800V demands retooling and new supplier ecosystems.

Manufacturer Strategies and Future Plans

Indian manufacturers are preparing for a higher-voltage future, with Tata Motors leading the charge. In June 2024, Tata announced plans to adopt 800V to 1000V architectures in the mid- to long-term, aiming to enhance charging speeds and efficiency for future models (Tata Motors 800-1000V Plans). Current Tata EVs, such as the Nexon EV and Curvv EV, use 400V systems, but the upcoming Avinya and Sierra EV models may introduce higher voltages (Tata Avinya Concept).

Other manufacturers, such as Mahindra and MG Motor, are likely to follow global trends. For instance, MG’s parent company, SAIC, is exploring 800V systems for international markets, which could influence its Indian lineup (India’s EV Market Trends). Global players like Hyundai and Maruti Suzuki, planning new EV launches in 2025, may also introduce 800V models, especially in premium segments (Carmakers Plan EV Onslaught).

Infrastructure and Market Dynamics

India’s charging infrastructure is a critical factor in the voltage transition. As of February 2024, the country had 12,146 public charging stations, primarily 400V-compatible (Electric Vehicle Industry in India). The government aims to expand this to 1.32 million stations by 2030, with initiatives like the PM-eBus Sewa scheme driving infrastructure growth. The Union Budget 2025 extended customs duty exemptions for EV battery production, supporting faster charging technologies (India’s EV Market Trends).

However, 800V charging stations remain scarce, posing a challenge for early adopters. Manufacturers like Tata Power are expanding high-power charging networks, which could support 800V systems in urban and highway corridors (Tata Motors Electric Vehicles).

Cost and Scalability

The higher cost of 800V systems is a significant barrier in India’s price-sensitive market. However, as global adoption increases, economies of scale are expected to reduce costs, making 800V more accessible (Most EV Industry to Shift to 800V). Government incentives and local manufacturing could further accelerate this trend.

Table: Comparison of 400V and 800V Architectures in India (2025)

| Aspect | 400V Systems | 800V Systems |

| Adoption | Dominant (e.g., Tata Nexon EV, Kia EV3, BMW iX) | Emerging (e.g., Audi Q6 e-tron, Mercedes-Benz CLA Electric) |

| Charging Speed | 150-250 kW, 10-80% in ~30 minutes | 270-320 kW, 10-80% in ~15-21 minutes |

| Cost | Lower, affordable for mass market | Higher, suited for premium segments |

| Infrastructure | Widely available (12,146 stations, Feb 2024) | Limited, expanding with high-power chargers |

| Efficiency | Higher current, more heat, heavier cables | Lower current, less heat, lighter components |

| Models (2025) | Kia EV3, BMW iX, Tata Nexon EV, MG ZS EV | Audi Q6 e-tron, Mercedes-Benz CLA Electric |

Conclusion

In 2025, India’s EV market is navigating a pivotal transition in voltage architectures. The 400V systems, powering models like the Tata Nexon EV, Kia EV3, and BMW iX, remain the cornerstone of affordable electric mobility, supported by a robust charging network. However, the introduction of 800V models, such as the Audi Q6 e-tron and Mercedes-Benz CLA Electric, signals a shift toward faster-charging, high-performance EVs. With Tata Motors and other manufacturers planning to adopt 800V to 1000V systems in the coming years, and infrastructure development accelerating, the stage is set for a higher-voltage future.

The transition will not be immediate, as cost and infrastructure challenges persist. Yet, as technology matures and consumer demand for convenience grows, 800V architecture is poised to redefine India’s EV landscape, offering faster charging, greater efficiency, and a more seamless driving experience. The voltage war is just beginning, and 2025 marks a critical turning point for India’s journey toward sustainable mobility.

Whoa! EVs are leveling up, From 400V to 800V. At Nikol EV, we’re already building the chargers that power this future, Excited to support a smarter, greener India.

Checkout our website here- http://www.nikolev.in

Contact- 8485853574