In a historic shift that underscores the rapid transformation of the global automotive industry, China has surpassed Japan as the world’s leading automobile manufacturer and exporter in 2025, driven primarily by the electric vehicle revolution that traditional Japanese automakers have been slow to embrace.

- Toyota’s Strategic Blindspot Proves Costly

- Catastrophic Decline in China Market

- Former Strongholds in Southeast Asia Under Siege

- China’s Competitive Strategy: Technology and Affordability

- The Subsidy Question: A Complex Picture

- Industrial Policy Spending for China’s EV Sector (US$ billion)

- Massive Overcapacity Threatens Industry Shakeout

- Outlook: Best and Worst of Times

According to analysis by Nikkei using standardized methodology across the US, Japan, and China, Chinese companies sold 27 million vehicles globally in 2025, capturing a 30% market share. Meanwhile, Japanese manufacturers saw sales decline to 25 million units with a 28% share, down from 34% in 2018 when they sold 30 million vehicles.

| Year | China | Japan | US |

| 2010 | 10 | 22 | 14 |

| 2015 | 12 | 26 | 15 |

| 2020 | 15 | 25 | 11 |

| 2025 | 27 | 25 | 10.5 |

Toyota’s Strategic Blindspot Proves Costly

The shift highlights what critics describe as strategic miscalculation by Japanese automakers, particularly Toyota. Chairman Akio Toyoda has publicly stated he cannot envision battery-electric vehicles (BEVs) exceeding 30% of the market, regardless of price reductions or technological advances a position that appears increasingly out of touch with market realities.

In China, the world’s largest auto market, New Energy Vehicles (NEVs) comprising battery EVs and plug-in hybrids reached 50% of total light vehicle sales in 2025, with December alone seeing 60% of passenger cars sold as NEVs. Conventional hybrids, where Japanese manufacturers have concentrated their investments, hold negligible market share.

Catastrophic Decline in China Market

The numbers tell a stark story of decline. Foreign brands’ share of China’s passenger car market has plummeted from 56% in 2017 to just 31% in 2025. While foreign manufacturers retain 67% of the internal combustion engine (ICE) segment, they hold merely 12% of the booming NEV market.

Japanese automakers have been particularly hard hit:

• Toyota: Sales fell 9% from peak of 1.94 million to 1.78 million in 2025

• Honda and Nissan: Catastrophic 60% collapse in sales since 2020

• Japanese NEV market share: Merely 1% despite holding 26% of ICE vehicle sales

Ironically, Toyota’s relatively better performance compared to Honda and Nissan stems partly from its sale of BEVs in China including the $15,000 bZ3X the very vehicles it has downplayed in other markets. The company plans to open a factory in 2027 to produce a BEV version of its Lexus brand for the Chinese market.

Former Strongholds in Southeast Asia Under Siege

Chinese manufacturers are making significant inroads into markets where Japanese brands once seemed unassailable. In Thailand, Japanese market share has declined from 80-90% to 70%. Across the ASEAN-6 countries (Indonesia, Thailand, Malaysia, Vietnam, Philippines, and Singapore), Japanese share fell from 70% in 2023 to 59% by mid-2025, while Chinese manufacturers surged from 3% to 9%.

The EV adoption rates in these markets explain the shift:

• Singapore: 45% EV share

• Vietnam: 38% EV share

• Thailand: 21% EV share

• Indonesia: 15% EV share

Honda reported 20% fewer sales in ASEAN’s major markets in the first half of 2025 compared to the previous year, with Chinese competition cited as a primary factor.

| Rank | Automaker | Capacity Utilization (%) |

| 1 | Tesla | 96% |

| 2 | Xiaomi | 95% |

| 3 | Chery | 89% |

| 4 | Li Auto | 85% |

| 5 | FAW-Hongqi | 83% |

| 6 | BYD | 82% |

| 7 | Guoxin | 82% |

| 8 | SAIC-Maxus | 6.6% |

| 9 | Zhengzhou Nissan | 2.7% |

| 10 | Yizhen Auto | 2.4% |

| 11 | Mengshiech | 1.9% |

| 12 | Weichai Auto | 1.9% |

| 13 | Haima Auto | 1.7% |

| 14 | Hainan Haima | 1.5% |

China’s Competitive Strategy: Technology and Affordability

Chinese automakers have positioned themselves strategically in middle-income markets with affordable EVs, contrasting sharply with Western manufacturers like Tesla and Ford who target affluent consumers with premium-priced vehicles. Ford recently abandoned its $70,000 EV pickup truck at significant financial loss, highlighting the challenges of high-price strategies.

Leading Chinese manufacturers charge up to twice as much in export markets as domestically, with profits from overseas sales helping offset losses from intense domestic price competition. For example, BYD’s Seal U Comfort costs $22,000 in China but $42,000 in Europe still undercutting Volkswagen’s comparable ID.4 at $46,000 in Europe ($31,000 in China).

To circumvent rising tariffs, Chinese companies are establishing overseas manufacturing facilities capable of producing 2 million vehicles annually by 2027, predominantly in Europe.

The Subsidy Question: A Complex Picture

Critics argue that China’s automotive success relies heavily on government subsidies enabling below-cost pricing. The reality, however, is more nuanced reminiscent of similar accusations leveled against Japan during its industrial rise in the 1970s-90s.

Research by Scott Kennedy at the Center for Strategic and International Studies (CSIS) reveals that national-level subsidies for BEVs and PHEVs totaled $230 billion from 2009-2023. However, following a classic “infant industry” policy approach, these subsidies have declined dramatically as the industry matured.

In 2023, per-vehicle subsidies dropped to $4,700 less than the $7,500 provided by the Biden administration, excluding US infrastructure support. Subsidies as a percentage of vehicle value fell from 42% (2009-17) to just 11% in 2023.

The shift accelerated in 2025 when China removed the 10% sales tax exemption for EVs (which represented 87% of all subsidies in 2023), implementing a 5% rate that will increase to the standard 10% by 2028. Internal combustion vehicles have not received equivalent support.

A dozen leading Chinese automakers have emerged as highly competitive in technology, quality, and market positioning, with rapidly diminishing reliance on subsidies. However, approximately 240 manufacturers continue operations, with many producing fewer than 1,000-10,000 units annually and surviving primarily through continued local government support.

Industrial Policy Spending for China’s EV Sector (US$ billion)

| Type / Metric | 2009–17 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Total / Overall |

| Rebate | 37.8 | 4.3 | 3.3 | 3.5 | 7.4 | 9.2 | 0.0 | 65.7 |

| Sales Tax Exemption | 10.8 | 7.7 | 6.4 | 6.6 | 16.4 | 30.3 | 39.6 | 117.7 |

| Infrastructure Subsidies | 2.3 | 0.2 | 0.2 | 0.3 | 0.3 | 0.6 | 0.6 | 4.5 |

| Research & Development | 2.0 | 3.6 | 3.4 | 3.5 | 4.3 | 3.9 | 4.3 | 25.0 |

| Government Procurement | 7.8 | 1.6 | 1.4 | 2.9 | 1.7 | 1.8 | 0.8 | 18.0 |

| Total Spending | 60.7 | 17.4 | 14.8 | 16.8 | 30.1 | 45.8 | 45.3 | 230.9 |

| Spending as % of Total EV Sales | 42.4% | 22.7% | 23.3% | 25.4% | 18.3% | 15.1% | 11.4% | 18.8% |

| Subsidy per Vehicle (US$) | – | 13,860 | 12,311 | 12,294 | 8,538 | 6,656 | 4,764 | – |

European Union Trade Agreement

In 2024, the EU imposed a 45% tariff, arguing that without subsidies, Chinese auto prices would be 45% higher. However, this month the EU and China reached an agreement replacing tariffs with minimum price agreements for each model and potential “voluntary” export caps. This arrangement may benefit European manufacturers like Volkswagen that import vehicles from Chinese factories.

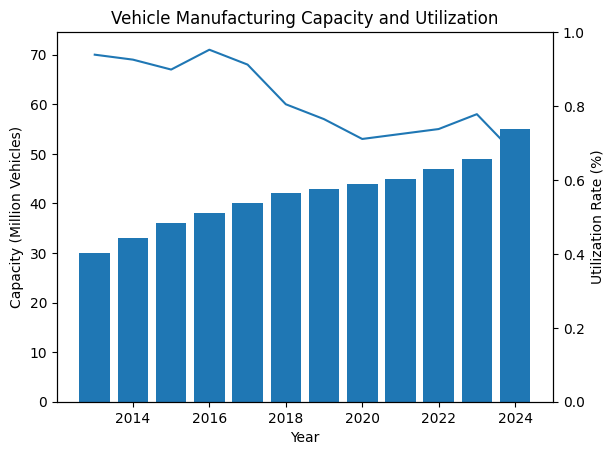

Massive Overcapacity Threatens Industry Shakeout

Perhaps the most serious challenge facing China’s automotive sector is massive overcapacity. Chinese manufacturers can produce 56 million vehicles annually but sell only 30 million representing nearly twice domestic demand and 60% of total global automotive sales by all manufacturers worldwide.

S&P Global Mobility projects China will produce only around 35 million vehicles a decade from now, suggesting significant capacity will never be utilized. Most excess capacity lies in ICE vehicle production, which consumers are rapidly abandoning. Industry-wide capacity utilization has halved, with wasted factory investments dragging down GDP growth.

Of 241 automobile manufacturers, approximately 20% produced fewer than 1,000 units in 2023, with another 17% producing under 10,000 units annually. Conversely, 15% of factories operated above 95% capacity utilization, accounting for 47% of China’s total 2023 output.

Inevitable Consolidation Ahead

Market consolidation appears inevitable. Of 129 companies currently manufacturing EVs, consulting firm AlixPartners predicts only 15 will survive to 2030. The top ten EV manufacturers already dominate with a 95% domestic market share, up dramatically from 60-70% just years ago.

This pattern mirrors historical precedents. In the United States, 1,300 automakers emerged and disappeared between 1895 and the early 1930s, experimenting with various technologies including wood, steam, gasoline, and batteries. Similar dynamics occurred during the dot-com era.

The critical question is whether China’s central, provincial, and local governments will permit necessary consolidation. The majority of 500 EV startups from 2018 have already ceased operations. However, governments and companies continue adding capacity despite overcapacity concerns, as provinces and localities compete to create automotive champions for employment and tax revenue dynamics paralleling China’s real estate boom.

Grey Market Exports Draw Government Crackdown

Overcapacity has spawned problematic “grey market” exports. Zombie manufacturers sell excess inventory to bulk buyers like Zcar, which exports vehicles as zero-mileage “used cars” at cut-rate prices without warranties or service support. Reportedly, 80% of China’s 500,000 “used car” exports in 2024 were such vehicles, priced thousands of dollars below official new car exports.

Beijing recently began cracking down on these sales due to concerns about damage to Chinese automotive brands’ reputation.

Outlook: Best and Worst of Times

China’s automotive industry presents a study in contrasts. A dozen world-class manufacturers demonstrate spectacular technology, quality, and competitive capability with diminishing subsidy dependence. Simultaneously, hundreds of marginal producers survive primarily through government support, operating at minimal capacity utilization.

For Japanese automakers, the challenge is existential. Their bet on conventional hybrids over battery-electric vehicles has proven catastrophically misaligned with market evolution. As one industry observer noted regarding the fundamental question facing traditional manufacturers: “How can you succeed when you don’t even offer the product that customers increasingly wish to buy?”

The global automotive landscape has fundamentally shifted, with electric vehicles no longer representing future potential but present reality a transition that China has embraced while Japan’s legacy manufacturers struggle to adapt.