5 mutual funds charging up on EV stocks in 2025

India’s electric vehicle (EV) sector is experiencing rapid growth, and mutual funds are increasingly backing this trend by investing in EV stocks in 2025. Let’s explores five key mutual funds that are leading the charge in 2025, highlighting their strategies and the EV companies they support.

- 5 mutual funds charging up on EV stocks in 2025

- 5 mutual funds charging up on EV stocks in 2025

- ▶️ Bandhan Transportation and Logistics Fund: A Sector-Focused Investment Opportunity

- ▶️ Aditya Birla SL Transportation and Logistics Fund: A Strategic Investment in Mobility

- ▶️ HDFC Defence Fund: A Sectoral Bet with EV Exposure

- ▶️ HDFC Transportation and Logistics Fund

- ▶️ UTI Transportation & Logistics Fund: A Sector-Focused Investment Opportunity

This information can help readers understand market trends and the future of sustainable transportation in India.

5 mutual funds charging up on EV stocks in 2025

▶️ Bandhan Transportation and Logistics Fund: A Sector-Focused Investment Opportunity

Introduced in October 2022, the Bandhan Transportation and Logistics Fund is dedicated to investing in companies operating within India’s dynamic transportation and logistics sector. The fund adopts a multi-cap approach, strategically distributing its investments across different market capitalizations. As of January 2025, its portfolio consists of 59.89% in large-cap stocks, 9.13% in mid-cap stocks, and 23.33% in small-cap stocks.

A key holding in the fund is Tata Motors Ltd., representing 6.83% of the portfolio. With a market presence valued at USD 37 billion, Tata Motors is a global leader in automobile manufacturing, offering a diverse range of vehicles, including passenger cars, SUVs, commercial trucks, buses, pickups, and defense vehicles.

The fund also maintains significant exposure to India’s evolving electric vehicle (EV) sector, investing in top EV-related companies such as Hero MotoCorp Ltd., Bosch Ltd., Bharat Forge Ltd., and Exide Industries Ltd.. As of now, EV-focused stocks constitute 24.81% of the fund’s total assets, reflecting its commitment to capitalizing on the future of sustainable mobility.

With its sector-specific focus and diversified allocation strategy, Bandhan Transportation and Logistics Fund presents an opportunity for investors seeking exposure to India’s growing transportation and logistics landscape.

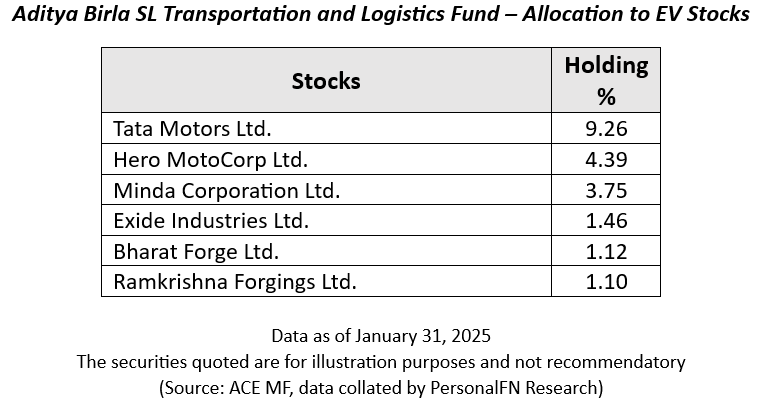

▶️ Aditya Birla SL Transportation and Logistics Fund: A Strategic Investment in Mobility

Introduced in November 2023, the Aditya Birla SL Transportation and Logistics Fund focuses on investing in companies aligned with the transportation and logistics sector. The fund’s portfolio is diversified, with 66.37% allocation to large-cap stocks, 9.95% to mid-cap stocks, and 20.95% to small-cap stocks.

A key highlight of the fund is its 21.08% allocation to electric vehicle (EV) stocks, with Tata Motors Ltd. holding the highest share at 11.75%. By strategically investing in companies across automotive, logistics, and allied industries, the fund aims to capitalize on the growing electrification trend within the mobility sector.

With a current Assets Under Management (AUM) of ₹1,430.20 crore, the scheme provides investors with exposure to both traditional and emerging players in the EV and transportation ecosystem, positioning itself as a potential avenue for long-term growth.

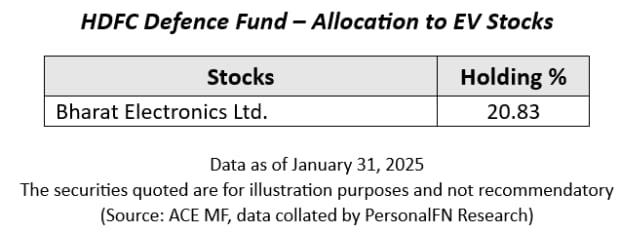

▶️ HDFC Defence Fund: A Sectoral Bet with EV Exposure

Launched in June 2023, the HDFC Defence Fund is designed to build a portfolio predominantly comprising equity and equity-related securities of companies operating in the defence and allied sectors. Given its recent entry into the market, the fund lacks an extensive performance history, making it essential for investors to assess their risk tolerance and investment suitability before committing.

While the fund primarily focuses on the defence sector, it also maintains a notable allocation to electric vehicle (EV) stocks. As of now, approximately 20.83% of the fund’s exposure is in Bharat Electronics Ltd. (BEL)—a key player in India’s defence and electronics industry that is actively expanding into the EV ecosystem.

BEL is developing cutting-edge battery management systems, charging infrastructure, and power electronics components vital for electric vehicles. With India’s accelerating shift towards EV adoption, BEL’s expertise in energy storage and power solutions positions it as a strong contender in the indigenous EV technology space.

As of January 2025, the fund’s asset allocation includes 47.74% in large-cap stocks, 9.79% in mid-cap stocks, and 39.60% in small-cap stocks. Investors should note the fund’s significant exposure to small-cap stocks, which tend to be more volatile. Given this, potential investors should carefully evaluate their risk appetite before investing in the scheme.

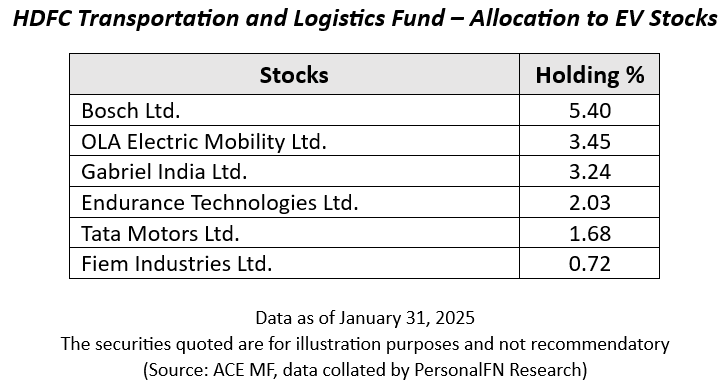

▶️ HDFC Transportation and Logistics Fund

The HDFC Pru Transportation and Logistics Fund is a thematic mutual fund that focuses on investing in a select portfolio of equity and equity-related instruments within the transportation and logistics sector.

As of January 2025, the fund manages an AUM of ₹1,278.31 crore. Its current allocation includes 52.72% in large-cap stocks, 15.03% in mid-cap stocks, and 23.57% in small-cap stocks.

The fund has a notable 16.52% allocation to electric vehicle (EV) stocks, with the highest exposure—5.40%—to Bosch Ltd.. Bosch is actively working with original equipment manufacturers (OEMs) to supply key components for electric two-wheelers, passenger vehicles, and commercial EVs. Its emphasis on localization and R&D in India aligns with the country’s shift towards sustainable mobility.

Additionally, the scheme holds investments in industry leaders such as OLA Electric Mobility Ltd., Gabriel India Ltd., and Endurance Technologies Ltd.. Since its launch in October 2022, the fund lacks a long-term performance history. Investors should evaluate their risk appetite and investment goals before committing to this scheme.

▶️ UTI Transportation & Logistics Fund: A Sector-Focused Investment Opportunity

The UTI Transportation & Logistics Fund is a sectoral mutual fund that primarily invests in companies operating in the transportation and logistics industry. Launched in April 2004, the fund has grown steadily and currently manages assets worth ₹3,333.95 crore (as of January 2025).

This scheme follows a multi-cap investment approach, strategically distributing its portfolio across market capitalizations:

- Large-cap allocation: 73.79%

- Mid-cap allocation: 9.20%

- Small-cap allocation: 12.19%

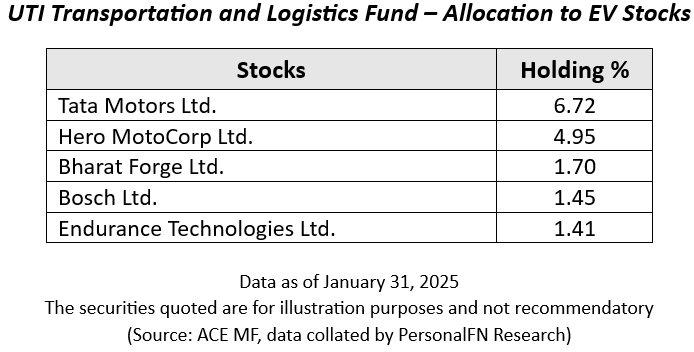

A notable feature of the fund is its significant exposure to electric vehicle (EV) stocks, reinforcing its commitment to future-ready transportation trends. Key holdings in the EV sector include:

- Tata Motors Ltd. – 6.72%

- Hero MotoCorp Ltd. – 5%

Overall, 16.23% of the fund’s assets are invested in EV-related stocks, reflecting its focus on emerging opportunities in sustainable mobility.

With its strong market presence and a forward-looking approach, the UTI Transportation & Logistics Fund offers investors exposure to a rapidly evolving sector that is set to play a crucial role in the future of mobility and logistics.