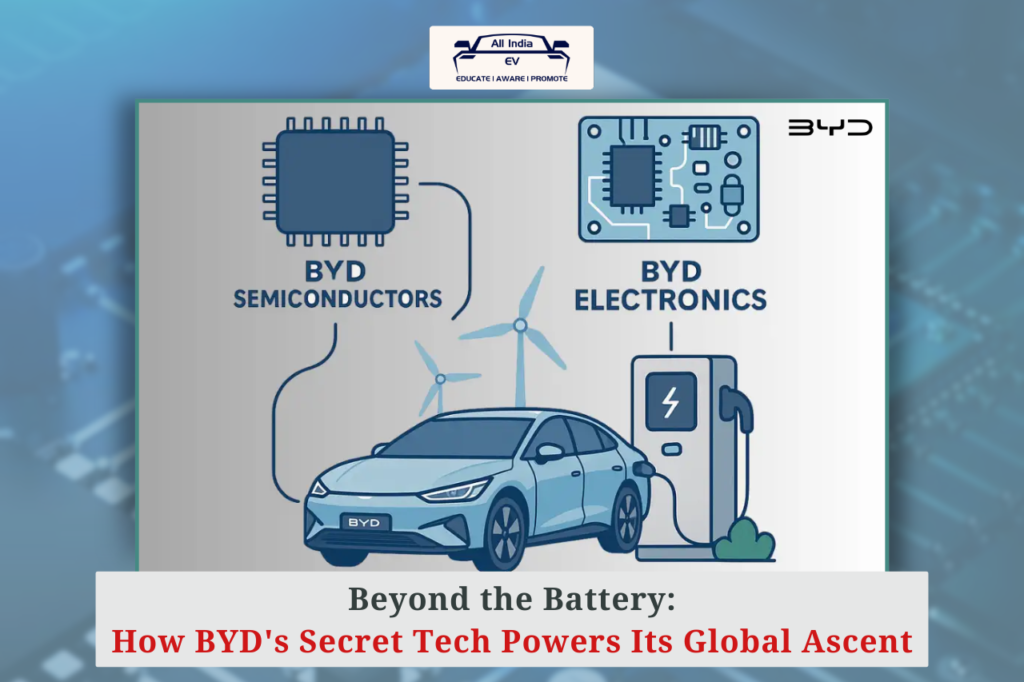

BYD’s Strategic Edge: How BYD Semiconductor, Born from Vertical Integration in 2020, Powers Its Global EV Leadership and Innovation

While most headlines around electric vehicles (EVs) tend to highlight Tesla’s innovations or Western policy shifts, one Chinese automaker is quietly reshaping the global mobility landscape from behind the scenes. BYD, now the world’s leading EV seller, is not just an automotive company—it’s a vertically integrated electronics and semiconductor powerhouse. And that may be the real engine behind its meteoric rise.

A Silent Revolution Within the EV Revolution

In early 2024, even Tesla CEO Elon Musk acknowledged the disruption, warning that Chinese EV makers could “demolish” global rivals without trade barriers. Topping that list is BYD, which surpassed Tesla in global EV sales by late 2023 and sold over 4.27 million EVs in 2024 alone.

But BYD’s success story isn’t just about vehicles. At the core of its dominance lies a self-sustaining tech ecosystem driven by its lesser-known divisions: BYD Electronics and BYD Semiconductor.

Building In-House to Build Big

Established in 1995, BYD Electronics began as a manufacturer of mobile phone parts and is now a key supplier for global brands like Apple, Samsung, and Huawei. Today, it produces handset frames, printed circuit boards (PCBs), and entire device assemblies.

This consumer tech legacy has powered BYD’s ability to internalize EV technologies—from infotainment systems and onboard chargers to custom semiconductors. This vertical integration has allowed BYD to innovate faster, control quality, and cut costs—all critical for the price-sensitive EV sector.

BYD Semiconductor: The Chip Arm That Fuels the Powertrain

Spun off in 2020, BYD Semiconductor focuses on core technologies like IGBT modules and Silicon Carbide (SiC) devices, both crucial to EV powertrains. By 2021, BYD was already producing 100,000 wafers monthly and had shipped over a million IGBT modules.

The 1200V/1040A SiC module launched in 2022 marked a turning point—enabling BYD to integrate SiC tech across all new models, enhancing charging speed, efficiency, and battery life.

Industry analysts from IHS Markit noted that BYD held 19–20% market share in IGBT modules by 2023, second only to Infineon—and some reports suggest it may have even overtaken the German giant within China.

Scaling with Strategy: Learning from BYD in an Indian Context

Unlike India’s current semiconductor focus, which emphasizes setting up fabs with over $10 billion in incentives, BYD followed a different route: start with real product demand, integrate deeply, and let scale drive chip production. The result is a resilient, end-to-end supply chain that meets both internal needs and external market demand.

For Indian OEMs like Tata Motors, Ola Electric, and Hero MotoCorp, and suppliers such as VVDN, Sona Comstar, and Dixon, BYD’s strategy may offer a valuable lesson: integrating electronics and chip design into EV development isn’t just an advantage—it’s becoming essential.

A Global Footprint with Local Lessons

In addition to its dominance in China, BYD is rapidly expanding its global EMS (Electronics Manufacturing Services) operations. Its $2.2 billion acquisition of Jabil’s China unit in 2023 extended its reach across consumer electronics and IoT. New manufacturing setups in Brazil, Hungary, Southeast Asia, and planned expansions into Mexico and Thailand further solidify its ambitions.

Though its semiconductor IPO was delayed in 2021 amid regulatory hurdles, and it still relies on older 4–6 inch wafers (compared to the more advanced 8-inch fabs), BYD’s growth trajectory remains strong.

Looking Beyond the Bus

In India, BYD is often seen through the narrow lens of electric buses or early EV ventures. But this perspective misses the bigger picture. The real power behind BYD is its ability to build from the chip up—creating a synergy across mobility, electronics, and semiconductors that few companies globally can match.

As India continues its push for EV leadership, understanding BYD’s integrated model could offer valuable insights—not just for automakers, but for the entire EV supply chain.