Electric L5 Three-Wheelers Offer Lower Running Costs, Faster Payback in 12–18 Months Despite Higher Upfront Price, Says Industry Report

India’s electric L5 passenger three-wheeler (E3W) market is undergoing a dramatic transformation, with a staggering 193.6% CAGR recorded between FY 2023 and FY 2025, according to a new report by JMK Research. The shift is being propelled by rising fleet electrification, government policy interventions, and long-term cost savings for commercial operators.

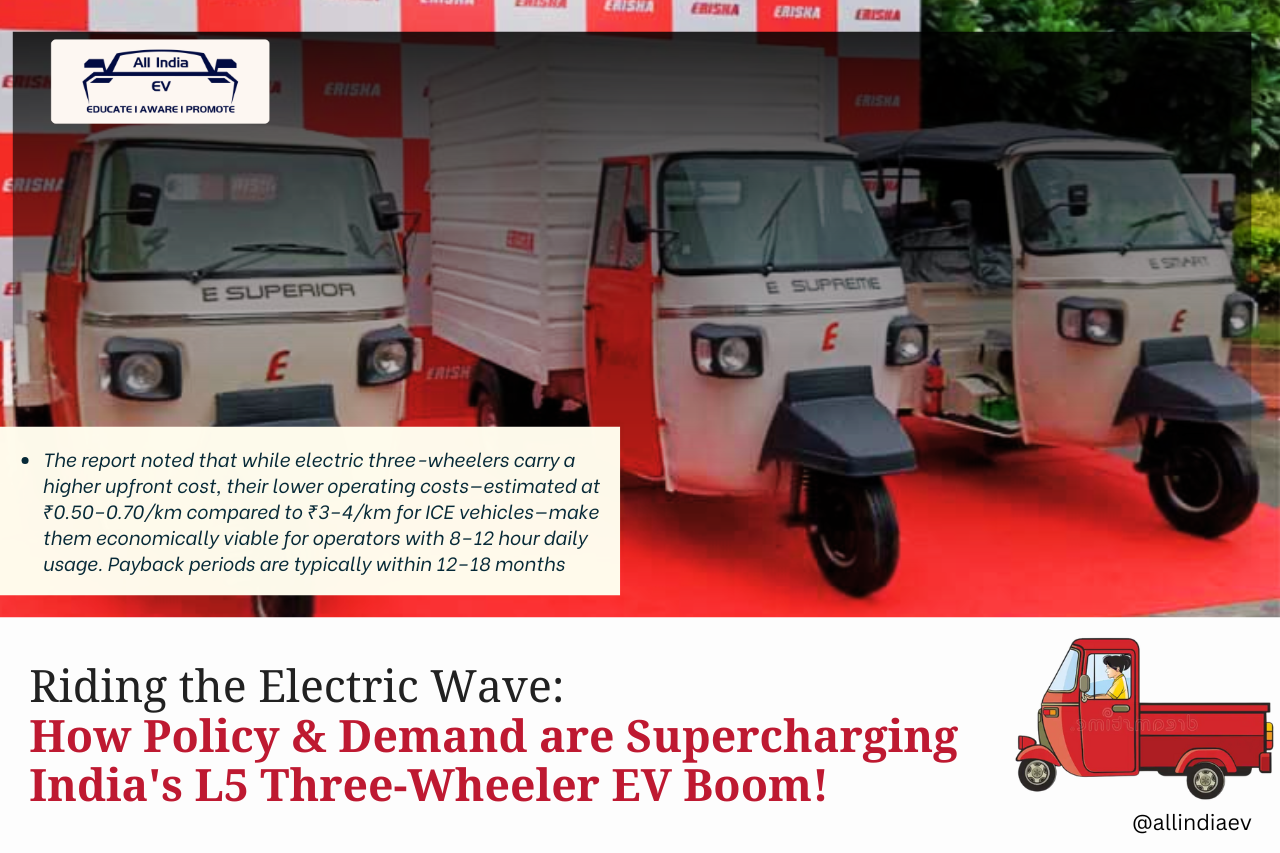

The L5 category, which includes high-powered, larger passenger three-wheelers, is rapidly displacing internal combustion engine (ICE) counterparts across urban and peri-urban India. Despite higher upfront costs, electric L5 vehicles are proving more viable due to their significantly lower operating costs—estimated at ₹1/km compared to ₹3–4/km for ICE models.

“For drivers operating 8–12 hours daily, the electric L5 segment offers a payback period of just 12–18 months, making it economically attractive for fleet and independent operators,” the report states.

Mahindra Leads, Bajaj Rises, TVS Enters the Fray

Mahindra Last Mile Mobility emerged as the market leader in FY 2025, selling 52,246 electric L5 units, with over 90% of its L5 portfolio electrified. The company’s success has been attributed to its strong after-sales support, affordable financing options, and a clear focus on electric-first strategies.

Bajaj Auto, a new entrant in the electric L5 passenger segment as of FY 2024, made a significant impact by selling 46,118 units in FY 2025. However, electric models accounted for just 12% of its total L5 sales, indicating a transitional strategy.

TVS Motor Company, which joined the electric L5 segment in January 2025, registered 1,696 electric units sold by the fiscal year-end, with a 7% electric penetration in the segment.

Piaggio Vehicles maintained a foothold in the electric segment but continues to rely predominantly on ICE models. Meanwhile, Omega Seiki Mobility (OSM) was commended for its focus on battery-swapping solutions, product innovation, and social impact initiatives like the “Pink Auto Rickshaw” program promoting female participation in last-mile mobility.

Fleet Demand & Urban Policies Accelerating Adoption

The report underscores a surge in fleet-driven demand, with aggregators like Uber and Rapido increasingly deploying electric L5 three-wheelers across Indian cities. OEMs are responding with India-optimized designs, improved range, and extended warranties tailored to high-usage scenarios.

“The momentum is shifting toward large-scale electrification in the last-mile passenger segment. Fleet electrification and city-level EV mandates are reshaping the commercial mobility landscape,” JMK Research observed.

One of the major policy signals highlighted in the report is Delhi’s draft EV Policy 2.0, which proposes to end the issuance and renewal of CNG auto-rickshaw permits. All new permits would be reserved exclusively for electric three-wheelers, signaling a seismic policy shift for urban transport electrification.

Future Hinges on Technology, Financing & Infrastructure

Looking ahead, the report emphasizes that the segment’s growth will depend on:

- Advancements in battery technologies

- Affordable, tailored financing solutions

- Expansion of charging and battery-swapping infrastructure

- State-level EV policy enforcement

Collaboration is Key

The report concludes that accelerating the electric L5 segment requires strong coordination among OEMs, policymakers, financiers, and fleet operators. Strategic partnerships and on-ground infrastructure development will be critical to achieving mass-scale electrification in India’s last-mile passenger mobility sector.