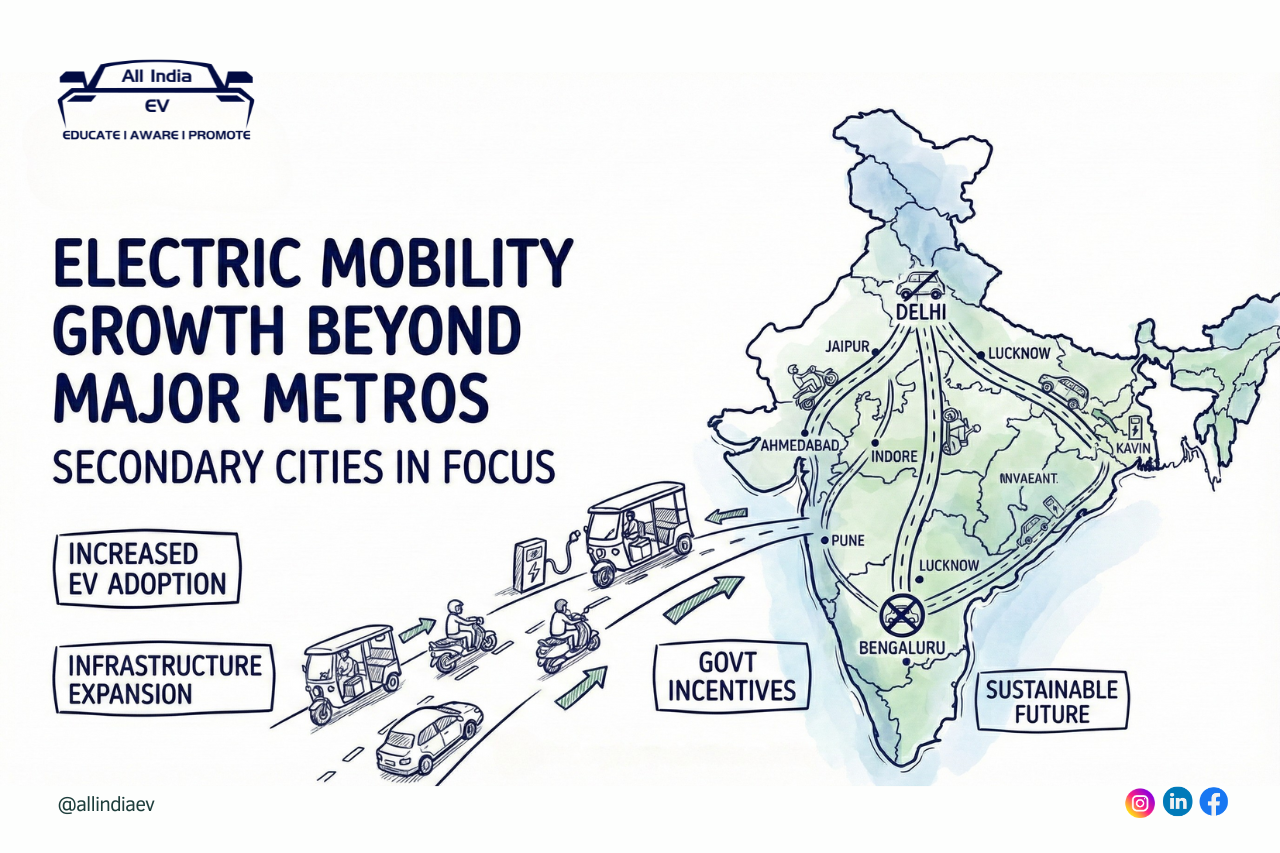

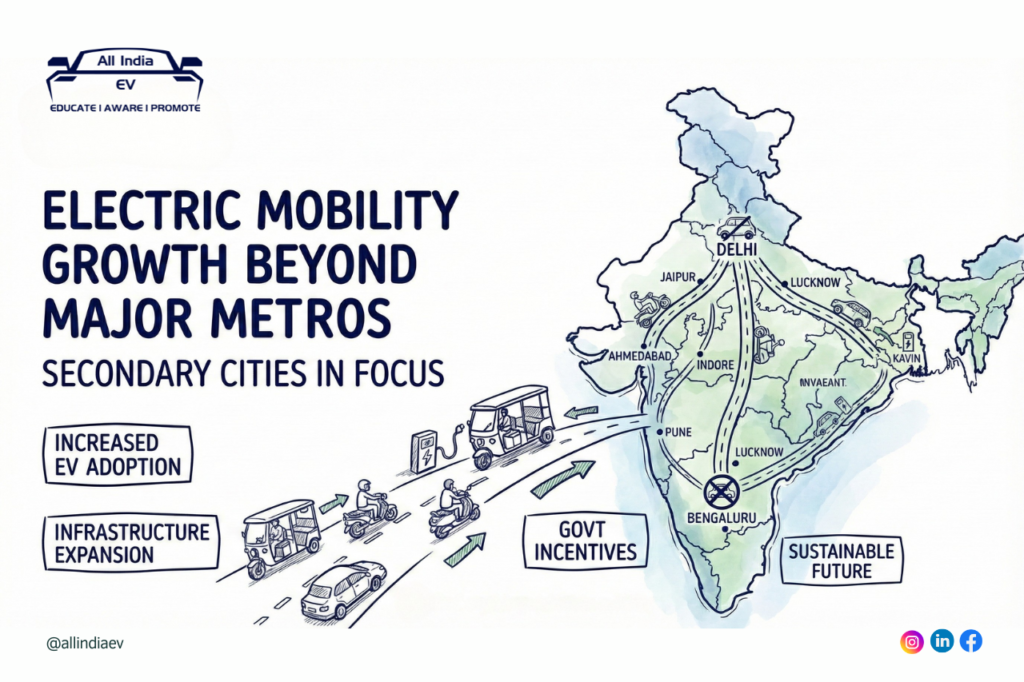

New Delhi: India’s electric vehicle (EV) transition is no longer a metro-centric story. While cities such as Delhi and Bengaluru continue to dominate headlines, the real momentum in electric mobility is now building across the country’s Tier-2 and Tier-3 cities. From e-scooters and e-rickshaws to electric buses and light commercial vehicles, smaller urban centres are emerging as the fastest-growing markets in India’s EV ecosystem.

- A nationwide push beyond the metros

- Measuring progress: The India Electric Mobility Index

- Two- and three-wheelers lead the transition

- Assam and Bihar: Rapid adoption in the east

- Chandigarh and Punjab: Strong policy signals in the north

- Momentum across states

- E-buses reshape public transport in smaller cities

- Central schemes drive investment and confidence

- Environmental and economic impact

- The road ahead

As of early 2025, India has crossed the milestone of more than 5.5 million electric vehicles on its roads, with sales accelerating year-on-year. Government officials and industry experts say the shift is being powered not only by climate and energy-security goals, but also by practical economics lower running costs, supportive state policies, and expanding charging infrastructure that make EVs particularly attractive in smaller cities.

A nationwide push beyond the metros

India’s EV growth is being driven by a combination of central schemes and state-level incentives designed to ensure electric mobility reaches beyond major metropolitan areas. Programmes such as FAME-II, PM eBus Sewa, PM e-DRIVE, and the Production-Linked Incentive (PLI) scheme for advanced battery cells are helping reduce upfront costs, strengthen domestic manufacturing, and build charging networks across the country.

Together, these initiatives align with India’s long-term objective of energy independence by 2047, while also addressing local challenges such as air pollution and rising fuel costs. The focus on secondary cities is particularly significant, as these urban centres are experiencing rapid population growth and rising transport demand.

Measuring progress: The India Electric Mobility Index

The India Electric Mobility Index (IEMI) provides a snapshot of how states and union territories are performing in building a robust EV ecosystem. The index evaluates parameters such as EV adoption, charging infrastructure availability, and policy support, grouping regions into three broad categories:

- Frontrunners: Delhi, Maharashtra, Chandigarh

- Performers: Karnataka, Tamil Nadu, Haryana

- Aspirants: Remaining states and UTs

While the frontrunners continue to lead, recent data shows aspirant states are closing the gap quickly largely due to aggressive policies aimed at two-wheelers and three-wheelers.

Two- and three-wheelers lead the transition

Electric two-wheelers (e-2Ws) and three-wheelers (e-3Ws) have become the backbone of EV adoption in smaller cities. Their popularity stems from low operating costs, ease of maintenance, and suitability for short-distance urban and peri-urban travel.

Industry estimates suggest all-India e-2W sales are on track to reach seven million units annually for the first time. Local markets, particularly in Tier-2 cities, are responding quickly as commuters and commercial operators shift away from petrol and diesel vehicles.

Assam and Bihar: Rapid adoption in the east

The eastern states provide some of the most striking examples of how policy support can accelerate EV adoption. In Assam, more than 85% of newly registered three-wheelers in 2024 were electric, driven by incentives such as waived road tax and registration fees for e-rickshaws. The state has also launched Baayu, one of India’s first app-based electric bike-taxi services, showcasing how e-bikes can serve as affordable urban mobility solutions.

Bihar has recorded similar momentum. Official data shows EV registrations nearly doubling from around 10,000 vehicles in FY24 to approximately 23,000 in FY25. E-scooters and e-rickshaws are increasingly visible across Bihar’s towns, offering drivers lower running costs and benefiting from state-backed incentives.

Chandigarh and Punjab: Strong policy signals in the north

In northern India, Chandigarh has emerged as a standout performer. Nearly 92% of new three-wheelers registered in the city by 2024 were electric, supported by incentives not only for e-rickshaws but also for electric bicycles. Chandigarh has also achieved a 65% electrification rate in its commercial vehicle fleet, reflecting the effectiveness of sustained public awareness campaigns and subsidies.

Neighbouring Punjab has committed ₹300 crore over three years to promote e-2Ws, e-cycles, e-autos, and electric light commercial vehicles. Public charging stations are being installed in cities such as Ludhiana, Amritsar, Jalandhar, Patiala, and Bathinda, making EV ownership more convenient and practical for drivers in smaller towns.

Momentum across states

Beyond the north and east, EV adoption is gathering pace nationwide. In Odisha, the state government has approved a large EV manufacturing complex, including a ₹4,000 crore investment by the JSW Group for EVs and components. Additional incentives, such as interest-free advances for government employees purchasing EVs, are further boosting demand.

In the far northeast, Arunachal Pradesh has begun deploying electric buses on intra-city routes in towns like Itanagar, Namsai, and Pasighat. Officials say these initiatives demonstrate that electric mobility is no longer confined to large urban centres, but is steadily reaching even geographically challenging regions.

Electric Vehicle Initiatives Across Indian States

| State / UT | Key EV Initiatives & Highlights |

| 🟧 Assam | In addition to e-rickshaw incentives, the state launched an e-2W taxi fleet (Baayu) to improve urban mobility in Guwahati. |

| 🟨 Punjab | Allocated ₹300 crore (US$ 34 million) for EV subsidies covering e-2Ws, e-autorickshaws, and e-LCVs; dedicated EV parking and street chargers planned in Ludhiana and Amritsar. |

| 🟩 Chandigarh | Introduced subsidies for e-cycles and EVs; led India in 2024 with 91.75% electric auto-rickshaws and achieved 5.35% electric passenger car adoption, the highest nationally. |

| 🟢 Bihar | EV registrations more than doubled from 10,000 to 23,000 within a year, driven by rapid adoption of e-scooters and e-autos in Patna and other cities. |

| 🟩 Odisha | Providing interest-free EV loans and investing heavily in a new EV manufacturing park, expected to boost local EV availability. |

| 🟢 Jammu and Kashmir | Rapid electrification of public transport: 200 e-buses already deployed, with 200 more in progress, serving Srinagar, Jammu, and other cities. |

| 🟢 Arunachal Pradesh | Launched electrified city bus services in Itanagar, Namsai, and Pasighat, marking a major milestone for EV adoption in remote regions. |

E-buses reshape public transport in smaller cities

Public transport is another area witnessing a major transformation. Historically, India’s nine largest metropolitan areas accounted for over 61% of the country’s public bus fleet, leaving many Tier-2 cities underserved. The PM eBus Sewa scheme aims to bridge this gap by rolling out electric buses across smaller urban centres.

Under the programme, 10,000 e-buses are currently being deployed in over 50 cities, with plans for an additional 20,000 in the coming years. According to transport experts, electric buses offer lower lifecycle costs and reduced dependence on imported fuel, while delivering cleaner and quieter urban mobility.

Studies by institutions such as the World Resources Institute (WRI)–India suggest that scaling e-buses in Tier-2 cities could play a critical role in achieving India’s long-term energy and climate goals. By 2047, policymakers envision a predominantly electric public transport system nationwide.

Central schemes drive investment and confidence

At the heart of India’s EV expansion are large-scale central government programmes. The FAME-II scheme (2019–24) allocated approximately ₹11,500 crore for EV purchase subsidies, charging infrastructure, and research and development. Building on this, the PM e-DRIVE scheme, announced in 2024, earmarks nearly ₹10,900 crore to support next-generation EV technologies.

Meanwhile, PM eBus Sewa carries an outlay of around ₹20,000 crore, covering not only vehicle procurement but also up to 10 years of operational support through public-private partnerships. Complementing these efforts is the ₹18,100 crore PLI scheme for advanced battery cells, aimed at strengthening domestic battery manufacturing and reducing import dependence.

Environmental and economic impact

The benefits of electric mobility extend well beyond cleaner vehicles. EVs produce zero tailpipe emissions, significantly reducing local air pollution in densely populated towns. This translates into improved public health outcomes and lower healthcare costs over time.

From an energy perspective, road transport accounts for roughly 13.5% of India’s energy-related emissions. Electrification offers a pathway to cut carbon emissions while shifting energy consumption from imported oil to domestically generated electricity, increasingly sourced from renewables.

Industry projections suggest India’s EV stock could exceed 17 million vehicles by 2030, bringing the country closer to its target of 30% EV penetration. Analysts note that rapid adoption in secondary cities will be critical to achieving these national milestones.

The road ahead

With sustained policy support and growing consumer acceptance, India’s Tier-2 and Tier-3 cities are poised to match or even surpass the EV adoption levels seen in major metros. Each e-auto, e-scooter, and e-bus added in a smaller city strengthens the country’s broader sustainability agenda.

As the electric mobility ecosystem matures, experts say the focus will increasingly shift to expanding charging infrastructure, improving grid readiness, and ensuring affordability for all income groups. What is already clear, however, is that India’s EV revolution is no longer limited to a handful of large cities it is becoming a truly nationwide movement.