Tesla and BYD Take the Lead in Global ZEV Transition, While Tata Motors and Japanese OEMs Struggle: ICCT Report

In the latest annual study evaluating the progress of major OEMs toward Zero-Emission Vehicles (ZEVs), USA’s Tesla and China’s BYD have emerged as ‘Leaders.’ Tata Motors, the only OEM from India, has been designated as a ‘Rising Star.’

However, it joins Toyota, Honda, Nissan, Mazda, and Suzuki in the ‘Laggards’ category. Notably, Tata Motors is considered a global OEM in this study due to its ownership of Jaguar Land Rover. The ICCT’s Global Automaker Rating Study analyzed the top 21 light-duty vehicle OEMs by volume, using 10 custom-designed metrics across three categories.

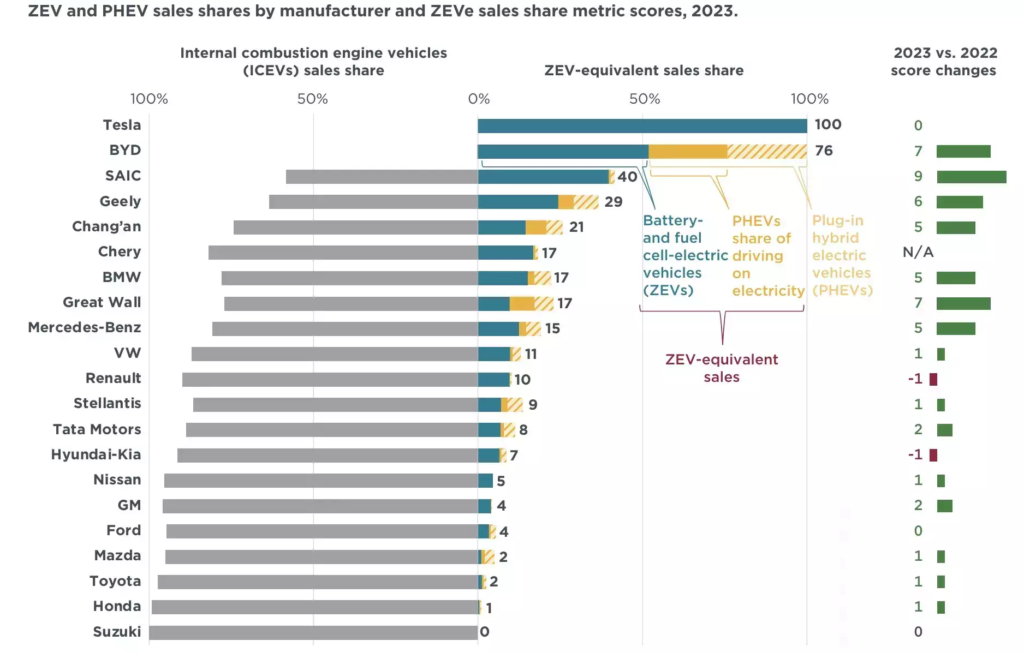

Under the “Technology Performance” category, the metrics include ZEV sales share, class coverage, energy consumption, charging speed, driving range, renewable energy battery recycling or repurposing, ZEV target, ZEV investment, and executive compensation. These measures “show the readiness to develop completely ZEV vehicles on a timeframe rapid enough to keep up with the worldwide transformation,” according to the independent research organization.

Image source: The ICCT

Tesla, BYD, and BMW, the top 3 OEMs on the list, received ratings of 84, 70, and 57, respectively. Tata Motors placed first in its group with 31.

In 2022, seven automakers had a gain in their numerical scores, twelve saw a decline, and one saw no change, according to the analysis conducted by ICCT. Twenty OEMs were covered in the 2022 edition. Due to its 18th place ranking in the world LDV sales in 2023, China’s Chery has been added this year.

“Our goal with this Report was to provide a data-driven, transparent analysis of automakers’ progress toward decarbonisation in their plans and actions. While most global automakers are making progress in the transition to zero-emission vehicles in different aspects, more work could definitely be done,”

says Amit Bhatt, India Managing Director, ICCT.

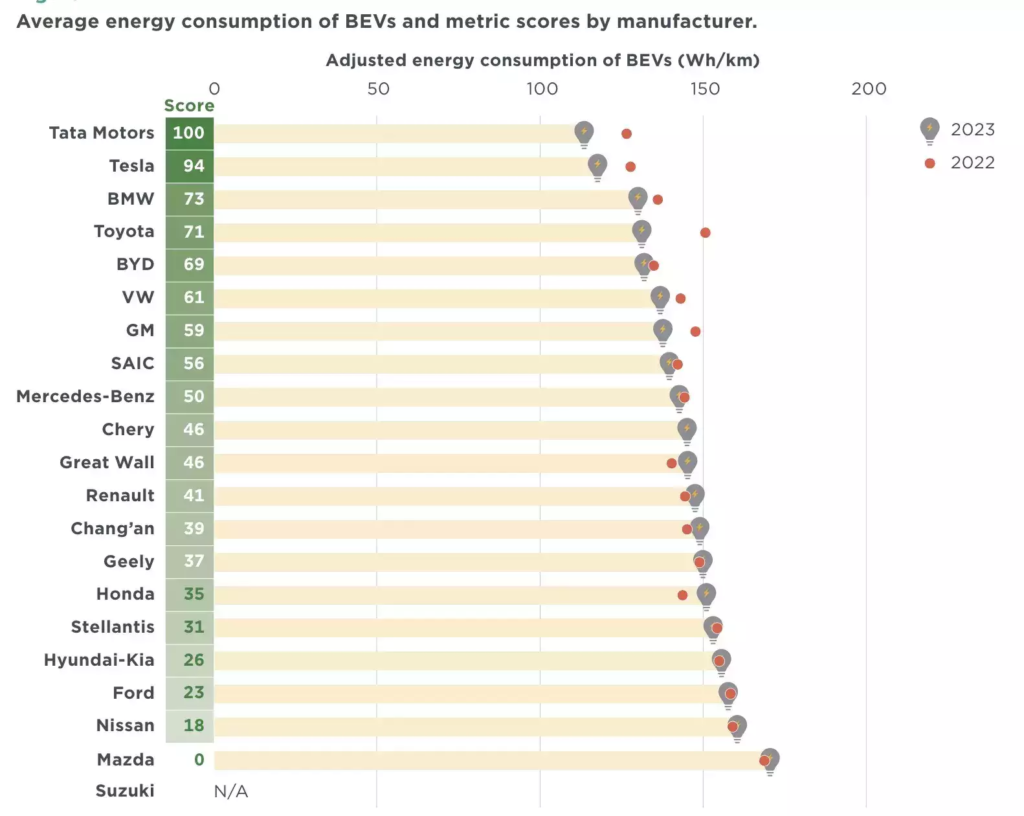

Tata Surpasses Tesla in Efficiency

According to the study report, eleven OEMs improved the efficiency of their BEVs by reducing average energy consumption. However, only seven of these saw a score increase compared to their competitors, as Tata Motors set a new benchmark, dethroning Tesla from the top spot. The report highlights that with its ongoing investments in EVs, Tata Motors ‘may be able to jump ahead of today’s Transitioners in future ratings.’ ‘Transitioners’ refers to the group between ‘Leaders’ and ‘Laggards’ in the study.

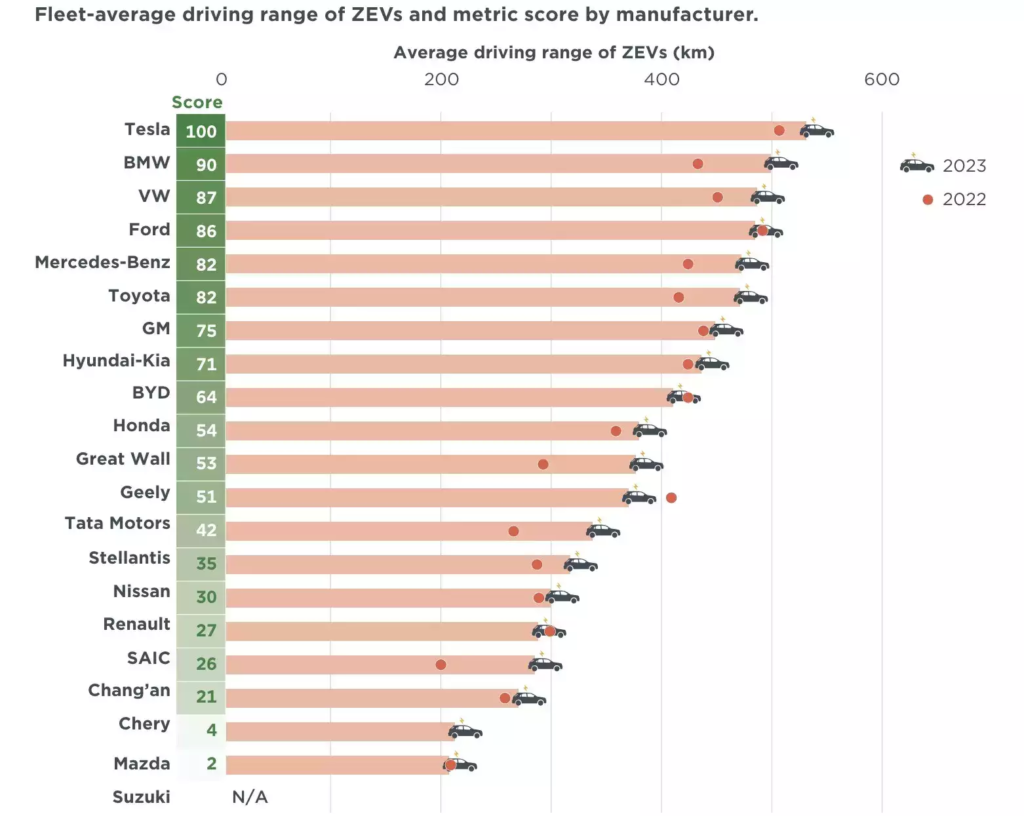

The study also finds that the average energy consumption of BEVs across OEMs fell by almost 4%, from 140 Wh/km in 2022 to 135 Wh/km in 2023, indicating significant technological progress in the industry. Fourteen of the twenty-one OEMs featured in the study improved the average driving range of their BEVs. Notably, SAIC, Great Wall, BMW, Tata Motors, and Toyota increased their driving ranges by over 50 km. On average, the BEV driving range across all manufacturers increased from 395 km in 2022 to 419 km in 2023.

Image source: The ICCT

Investing for the Transition

Thirteen automakers have increased their investments in the ZEV transition compared to the previous year. Tesla led the way, investing USD 3,740 per vehicle. The study found that seven OEMs have ‘either introduced or strengthened linkages between top executives’ compensation packages and ZEVs or vehicle CO2.’ Stellantis, BMW, and GM saw a higher share of executive pay tied to EV deployment in 2023 compared to 2022.

Additionally, Ford and Mercedes-Benz linked executive compensation packages to EVs for the first time in 2023, while Geely-owned Volvo Car and Tata Motors’ Jaguar Land Rover added a CO2 emissions component to their compensation models. The report highlights that ‘this trend shows that success in the ZEV transition is increasingly seen as critical to the future financial viability of the automotive industry.’

“To be competitive into the future, OEMs will need to expand their ZEV models on offer to help boost their ZEV sales share while improving ZEV technology performance,”

said Zifei Yang, Global Passenger Vehicle Program Lead at the ICCT and author of the study report.

According to the report, there was a 10% and 42% increase in the total number of ZEV models in each of the six markets covered. Almost all OEMs had ZEV models in the SUV/MPV class, except for Suzuki, which had no ZEV models in any class and offered only plug-in hybrid SUVs. The study covered China, USA, Europe, India, Japan, and the Republic of Korea, which collectively contributed about 82% of global LDV sales in recent years, according to market intelligence firm MarkLines.

Technology Bets

The ICCT bets on BEV and FCEV as the best technology options for clean mobility. Its modeling indicates that ‘nearly 100% of new light-duty vehicles sold in leading markets in 2035 must have zero tailpipe emissions to align the transportation sector with the goal of limiting global warming to below 2°C, as defined in the Paris Climate Agreement.’ Stephanie Searle, ICCT’s Chief Program Officer, stated, “Automakers that are slow to invest in the advanced technologies that regulations are designed to promote may soon find themselves outpaced by competitors who more wisely bet on the future.”

Image source: The ICCT

ZEV Transition Challenge in India

The global focus on decarbonization is reflected in the increasing share of EVs in the overall sales of light-duty vehicles (LDVs). According to the ICCT, EVs constitute 33% of LDV sales in China, 21% in Europe, and 9% in the United States. Additionally, 46% of LDV sales in 2023 were from automakers that have set targets to phase out internal combustion engine (ICE) vehicles.

However, the transition to ZEVs in India is progressing more slowly due to several key challenges, including inadequate charging infrastructure and customer apprehension, primarily regarding affordability. ICCT’s research identifies five effective policies that have accelerated the EV transition globally: financial incentives, outreach and communication, charging infrastructure development, ZEV sales mandates, and ICE phaseout targets.

“We have done comparatively well in the first three, which are mostly demand-side policies, and we need to continue these efforts. However, we also need to focus on the last two, which are supply-side policies. Implementing these in India can rapidly scale up EV deployment,”

says Bhat.

Currently, Tata Motors and MG are the primary drivers of the domestic passenger EV market. By 2025, the segment is expected to expand significantly with new models from OEMs like Hyundai, Mahindra, MG, and Tata. It is estimated that 30% of the passenger vehicle market in India could be EVs by 2030.

Content Credit: ET Auto

(You can now subscribe to our All India EV WhatsApp channel)