People say India is like three countries stitched together: Tier 1, Tier 2, Tier 3. From an All India EV (AIEV) lens, that line isn’t a meme, it’s an operating truth.

Because “India’s energy transition” looks very different depending on which India you’re standing in.

- Tier 1 India behaves like a dense, high-income, high-expectation “city-state” economy: peak-heavy loads, premium reliability demands, fast charging, and policy visibility.

- Tier 2 India behaves like a scaling industrial nation: rising cooling loads, chaotic urbanisation, mixed grid quality, and adoption driven by cost-per-km logic.

- Tier 3 India behaves like an access and productivity economy: reliability and affordability matter more than “net zero slogans”, and distribution performance decides everything.

The uncomfortable part: we keep designing policy, capital, and infrastructure as if it’s one country.

The macro signal: demand is rising, but quality is fragmenting

At the national level, India’s power system has expanded and stabilised meaningfully. The Ministry of Power’s Year End Review states India met an all-time maximum demand of 250 GW in FY 2024–25, and cites per-capita electricity consumption at 1,395 kWh in 2023–24. It also notes improved availability: 21.9 hours (rural) and 23.4 hours (urban) on average.

So yes, the grid is bigger and stronger.

But the experience of the grid is not uniform. And EV adoption is basically a mirror held up to distribution reality.

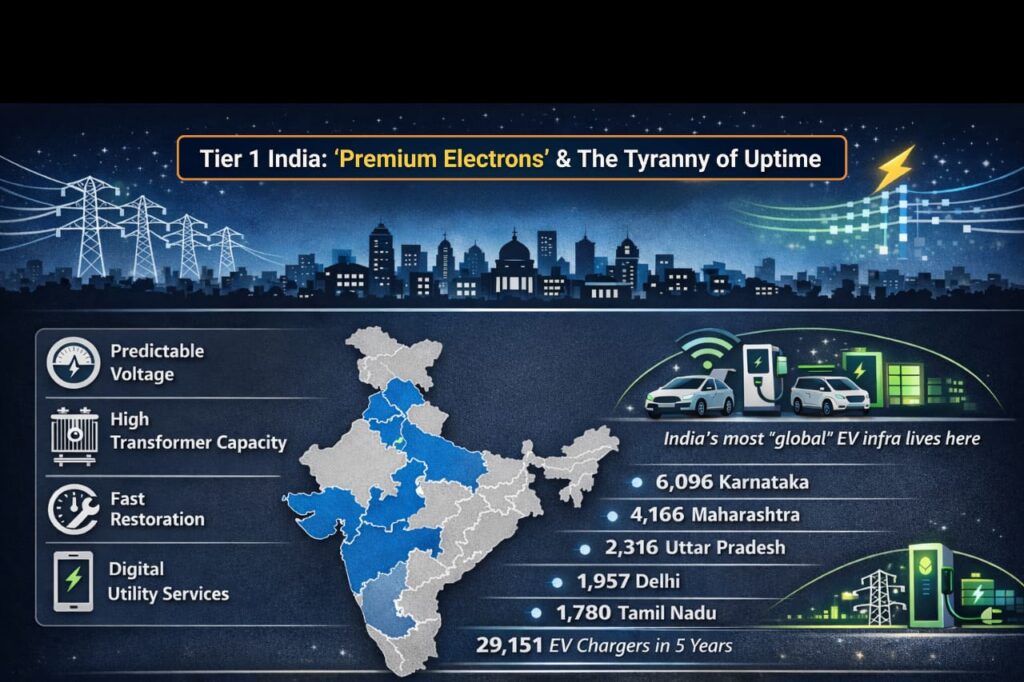

Tier 1 India: “Premium electrons” and the tyranny of uptime ⚡

Tier 1 India is where electricity is no longer just a commodity, it’s a service-level expectation.

Think: Delhi, Bengaluru, Mumbai, Hyderabad, NCR belts, top industrial corridors. Here, consumers don’t tolerate “power aayegi kal”. They want:

- predictable voltage,

- high transformer capacity,

- fast restoration,

- and digital service.

This is also where the EV ecosystem looks most “global”: DC fast charging hubs, fleet telematics, app-first roaming, higher 4W penetration, and the early wave of BESS-backed charging.

The EV infra footprint already shows this skew

In the last five years, India installed 29,151 EV charging stations (fast: 8,805, slow: 20,346). And the state-wise distribution screams “Tier 1 gravity”:

- Karnataka: 6,096

- Maharashtra: 4,166

- Uttar Pradesh: 2,316

- Delhi: 1,957

- Tamil Nadu: 1,780

- Gujarat: 1,205

(among others)

This is not just “more EV love” in these states. It’s where power quality + enforcement + purchasing power + municipal approvals can work together.

Tier 1’s big constraint isn’t adoption. It’s grid-facing execution:

- demand spikes (especially summer cooling),

- feeder capacity at high-footfall locations,

- and uptime economics for high-power chargers.

In Tier 1, the market rewards operators who can deliver availability as a product.

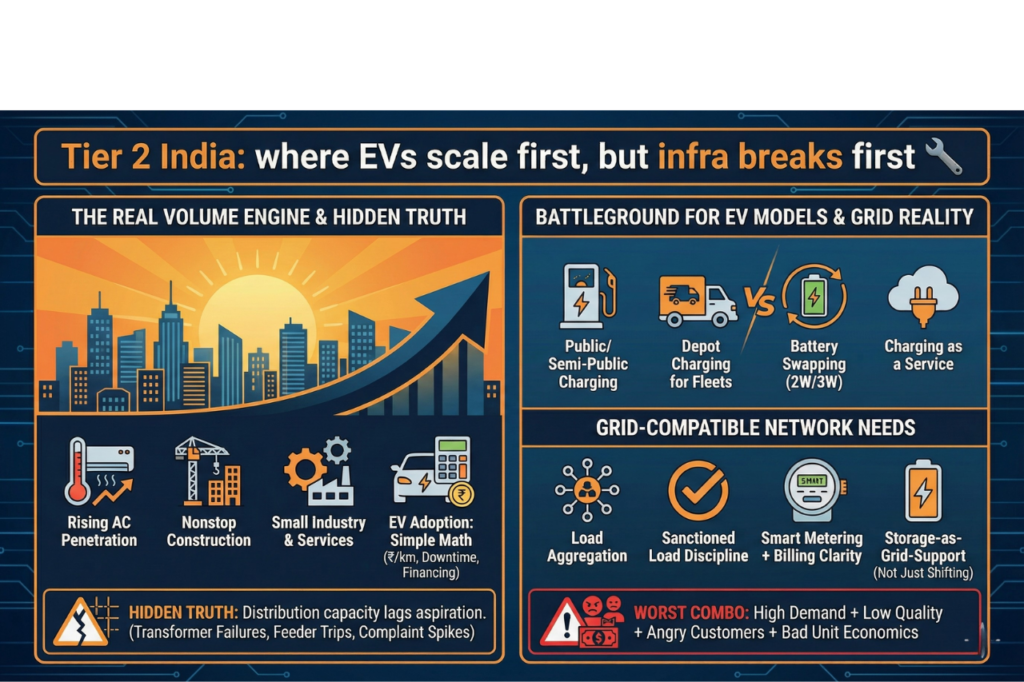

Tier 2 India: where EVs scale first, but infra breaks first 🔧

Tier 2 India is the real volume engine. It’s also where the grid gets stress-tested in public.

This is the “growth India” where:

- AC penetration is rising,

- construction is nonstop,

- small industry and services loads expand,

- and EV adoption is driven by simple math: ₹/km, downtime, and financing.

But Tier 2 also exposes the hidden truth: distribution capacity doesn’t scale at the same speed as aspiration.

You can see this pattern in summer demand spikes and service strain in smaller cities, where demand records come with reliability pain (transformer failures, feeder trips, complaint spikes).

Why Tier 2 is the battleground for EV charging business models

Tier 2 is where you’ll see the most competition between:

- public/semi-public charging,

- depot charging for fleets,

- battery swapping (especially for 2W/3W),

- and “charging as a service” models.

But here’s the catch: Tier 2 doesn’t need a glossy charging network. It needs a grid-compatible charging network.

That means:

- load aggregation,

- sanctioned load discipline,

- smart metering + billing clarity,

- and (soon) storage-as-grid-support, not just energy shifting.

If Tier 2 isn’t planned with distribution constraints upfront, you get the worst combo: high demand + low quality + angry customers + bad unit economics.

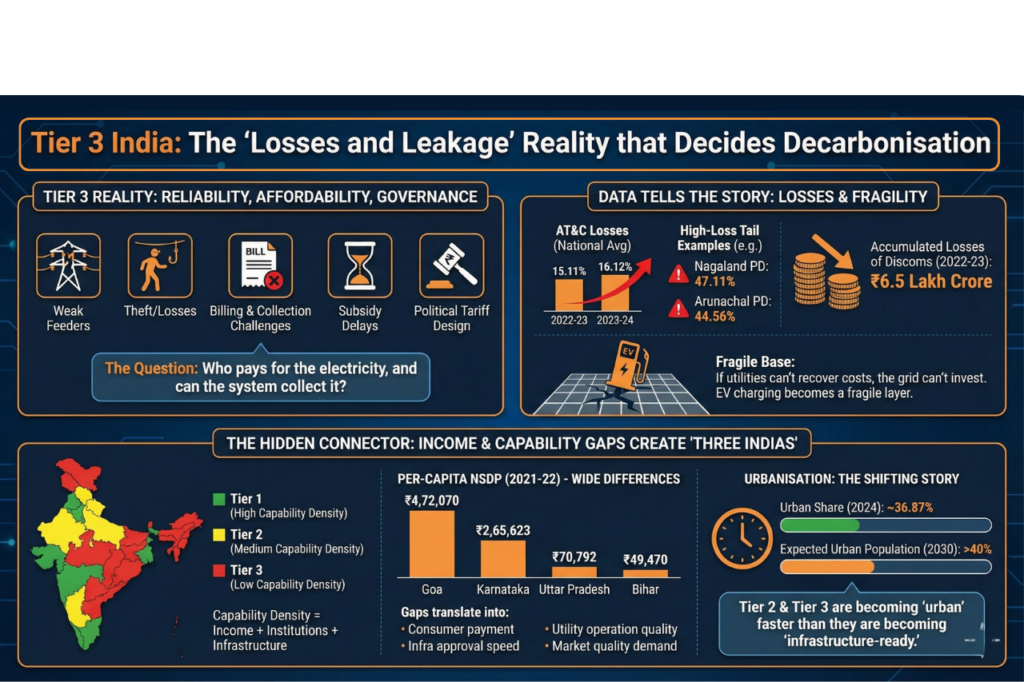

Tier 3 India: the “losses and leakage” reality that decides decarbonisation

Tier 3 India is where energy transition becomes less about carbon, more about reliability, affordability, and governance.

Here, the system is often constrained by:

- weak feeders,

- theft/losses,

- billing and collection challenges,

- subsidy delays,

- and political tariff design.

Two data points tell the story:

- AT&C losses at the national level averaged 16.12% in 2023–24 (up from 15.11% in 2022–23). Some utilities are extremely low-loss, but the high-loss tail is brutal (examples cited include 47.11% for Nagaland PD, 44.56% Arunachal PD, etc.).

- Accumulated losses of power distribution companies were cited at ₹6.5 lakh crore in 2022–23 (RBI “State Finances” referenced in a Lok Sabha reply).

In Tier 3 India, the question isn’t “Should we deploy EV charging?”

It’s: Who pays for the electricity, and can the system collect it?

Because if distribution utilities can’t recover costs, the grid can’t invest. And if the grid can’t invest, EV charging becomes a fragile layer on top of a fragile base.

The hidden connector: income and capability gaps create “three Indias” in energy too

Tiering isn’t just about city labels. It’s about capability density: income, institutions, and infrastructure.

Government data on per-capita NSDP shows how wide state-level income differences can be (for example, Goa: ₹4,72,070 in 2021–22, Bihar: ₹49,470 in 2021–22, Karnataka: ₹2,65,623 in 2021–22, Uttar Pradesh: ₹70,792 in 2021–22).

That gap translates into:

- what consumers can pay,

- how fast infra is approved,

- how well utilities operate,

- and what quality standard the market demands.

Even urbanisation is telling us the story is shifting fast: India’s urban share is reported around 36.87% (2024) using World Bank indicators compiled by aggregators, and India is expected to cross 40% urban population by 2030 per an Economic Survey reference in a government release.

Which means: Tier 2 and Tier 3 are becoming “urban” faster than they are becoming “infrastructure-ready.”

So what’s the thought-provoking conclusion?

India doesn’t have one energy transition. It has a portfolio.

Tier 1 needs premium reliability and grid-integrated fast charging.

Tier 2 needs distribution-first scaling and commercially viable fleet energy models.

Tier 3 needs loss reduction + billing discipline + affordability engineering before it needs shiny charging stations.

Trying to run one national playbook across all three is like shipping one vehicle for:

- Formula 1 tracks,

- broken city roads,

- and mountain trails…

…then blaming “consumer awareness” when it doesn’t work.

Operator-grade takeaways (AIEV-style, no fluff)

- Policy must become tier-aware.

One set of standards for interoperability and safety, yes, but different execution pathways for distribution upgrades, metering, and tariffs depending on grid maturity. - Charging infra targets should be grid-linked, not only unit-linked.

Counting chargers without feeder capacity planning creates stranded assets and uptime failures. - Capital must price in distribution risk.

In Tier 2/3, the moat is not “number of chargers”, it’s power availability + collections + O&M discipline. - Storage will split into two stories.

Tier 1: storage improves uptime and peak management for high-power hubs.

Tier 2/3: storage becomes a reliability tool only if the utility can monetise it. - The real national KPI is not EV sales alone.

It’s grid quality at the edge: AT&C losses, billing/collection, voltage stability, downtime. Because EVs amplify whatever the grid already is.