1) BPAN’s True Systemic Intent

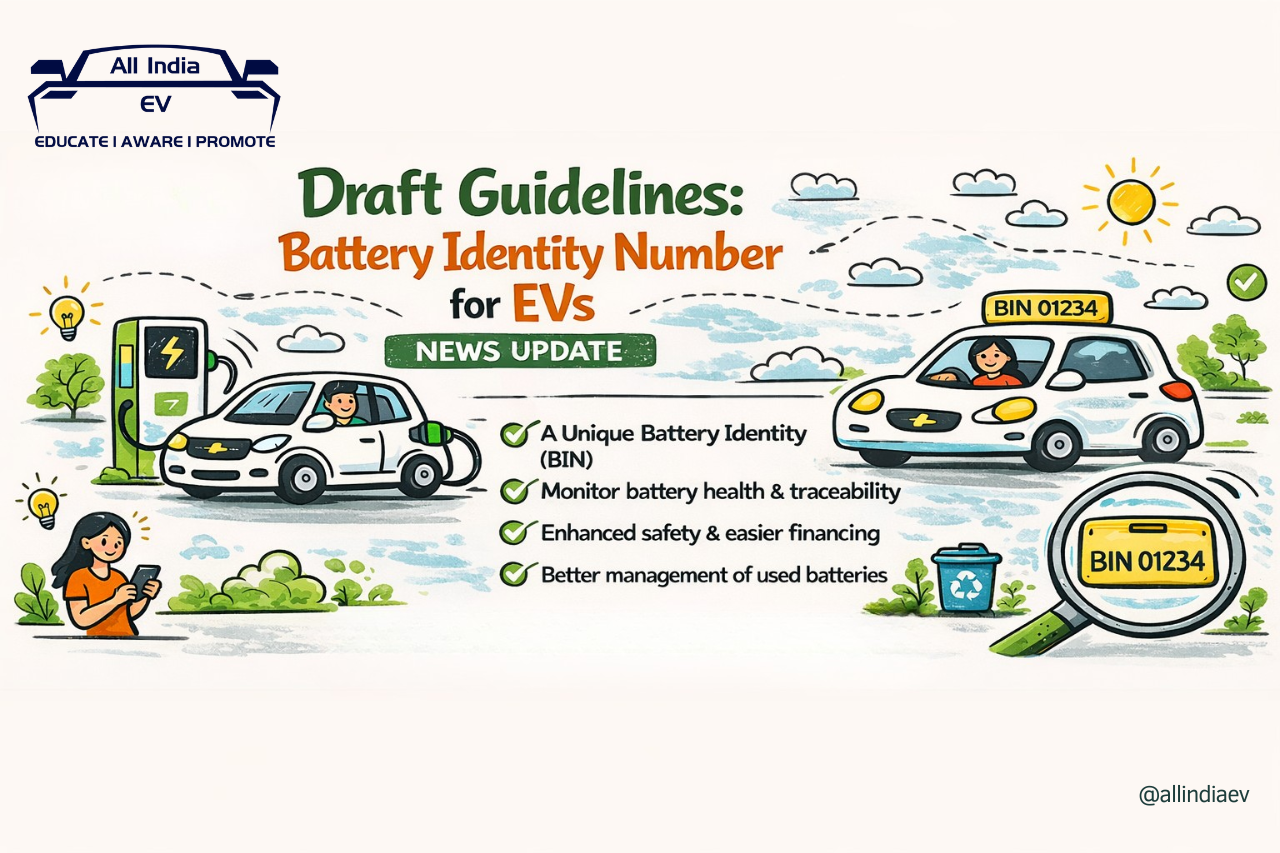

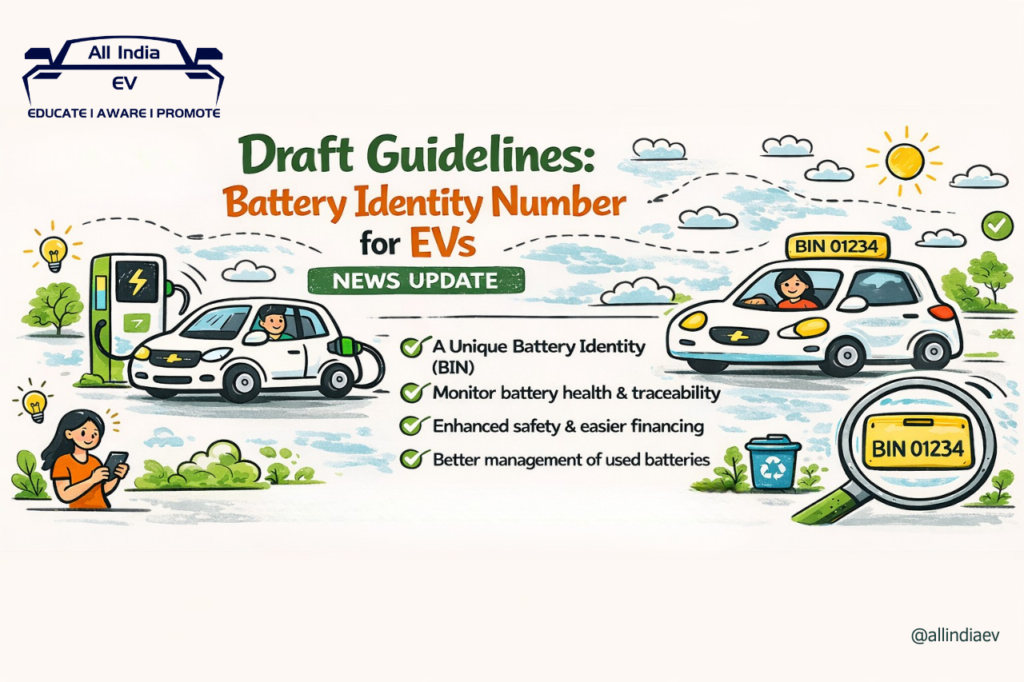

At face value, BPAN is a unique 21-digit digital identity for each battery pack that enables lifecycle-level traceability — from raw materials through manufacturing, in-use performance, second life, recycling, and end disposal. Static and dynamic data — including health, state of health (SoH), carbon footprint, composition, and origin — are to be hosted in a central system.

But the deeper paradigms being nudged here are:

- Asset transparency over asset opacity: this is a structural shift from vehicles as black-boxed products to batteries as persistent digital assets in the mobility ecosystem.

- Performance economics: data on health (SoH, cycles, thermal history) can finally address the chronic issue of residual value uncertainty — a fundamental friction in EV financing.

- Chain accountability: tracking raw materials and carbon footprint hints at aligning with European Battery Regulation frameworks, but tailored to India’s scale and cost constraints.

This is less a traceability label and more an information infrastructure layer for the evolving EV industry — much like a “digital VIN for batteries.”

2) Execution and Data Integration Will Make or Break It

Draft guidelines are easy; real integration is not:

- Who writes to whom? BPAN places the onus on battery producers/importers to assign IDs and upload dynamic data. But data fidelity, frequency, telemetry standards, and API integration with OEMs/charging networks are undefined. Fragmented reporting could limit value.

- Telematics dependency: Real-time health diagnostics require robust telematics architectures. Smaller OEMs, LCVs, 2/3-wheelers, and retrofitted battery systems might lack uniform data connectivity. If not incentivised or mandated, data gaps emerge.

- Financiers and insurers must integrate BPAN data into risk models and underwriting systems. Without a trusted, verifiable, independent dataset, BPAN could become another document to check — not a dynamic risk signal.

- Standardisation urgency: Without clear national standards for telemetry protocols, state of health definitions, and data reporting cadence, BPAN risks heterogeneous data quality that frustrates analytics.

In other words, BPAN’s impact depends on the clarity of implementation standards and data governance, not merely on assigning identifiers.

3) Policy Coherence and Cross-Ministry Alignment

BPAN sits at the intersection of ministries: Road Transport & Highways (MoRTH), Heavy Industries, New & Renewable Energy, and Commerce & Industry.

- PLI Scheme Nexus: Mint’s reporting flags BPAN as a mechanism to verify local production claims under the Advanced Chemistry Cell PLI scheme. This positions BPAN as both a policy compliance tool and a market transparency mechanism.

- Certification vs. Enforcement: Will BPAN become a precondition for registration, insurance, and resale transfers? If not, its adoption beyond large OEMs may lag.

- Circular economy alignment: India’s nascent battery recycling industry needs predictable feedstock flows. BPAN could facilitate this, but only if recycling actors can reliably read, trust, and use dynamic data.

This requires cross-departmental standardisation — something India’s EV policy architecture is only beginning to deliver.

4) Second-Order Market Impacts

Financing and Residual Value Models

Standardised state of health reporting could unlock:

- Battery-backed securities: If BPAN data is trusted, financiers might securitise contracts based on predictable battery health and residual value curves.

- Collateral innovation: Batteries have been poor collateral due to opaque depreciation; BPAN could change that narrative.

However, the legal framework for using BPAN data in contracts, repossession, or third-party verification needs clarity.

Used EV Marketplace

Today’s used EV market is stunted by battery health uncertainty.

- BPAN could provide a trusted health ledger if dynamic data is immutable and transparent.

- However, data privacy regimes and ownership rights over battery performance data will become hotly debated — especially between OEMs and vehicle owners.

Recycling and Second Life Economics

BPAN could be the backbone for a circular battery economy:

- Feedstock visibility accelerates recycling yield optimisation.

- Second life applications (stationary storage) can utilise BPAN’s historic performance data to price repurposed batteries.

But for this to work, recyclers and second-life operators must gain secure, real-time access to BPAN databases — requiring data exchange protocols and privacy safeguards.

5) Risks and Realities

1) Over-Engineering vs. Practical Utility:

Policymakers can easily burden the ecosystem with data requirements that exceed industry readiness — especially for MSME battery assemblers and regional players.

2) Enforcement without Enablement:

Mandates without capacity building, incentives, and clear operational playbooks tend to produce compliance boxes rather than functional systems.

3) Geopolitical Supply Chain Signals:

By embedding origin and composition details in BPAN, India could introduce de facto supply chain provenance reporting — a step toward ethical battery sourcing documentation. But this also exposes domestic producers to scrutiny from global regulators and trade partners.

6) The Hard Questions for Stakeholders

For Policymakers:

- How will BPAN data be validated and audited?

- Will there be penalties for misreporting?

- Will the BPAN system be hosted centrally (MoRTH) or federated with industry participation?

For OEMs & Battery Makers:

- How do we standardise SoH metrics across chemistries and use cases?

- Who owns the battery performance data — OEMs, telematics providers, or vehicle owners?

For Financiers:

- Can BPAN data be trusted for underwriting without third-party verification?

- Will regulators allow BPAN data to influence loan restructuring, repossession, or insurance claims?

For Recyclers & Second-Life Operators:

- Will dynamic BPAN data shape pricing of repurposed batteries?

- How will data privacy and access control be structured?

BPAN is a structural pivot point — a move from opaque asset treatment to traceable, data-driven lifecycle management for EV batteries. Its value won’t come from the identifier itself, but from the ecosystem of data integration, standards, and market practices that emerge around it.

If executed well, BPAN could become India’s equivalent of a digital battery passport — calibrated to domestic industry realities, competitive globally, and capable of reshaping financing, resale, recycling, and regulation.

If executed poorly, it will be a compliance label with little operational impact — a digitised sticker without systemic value.