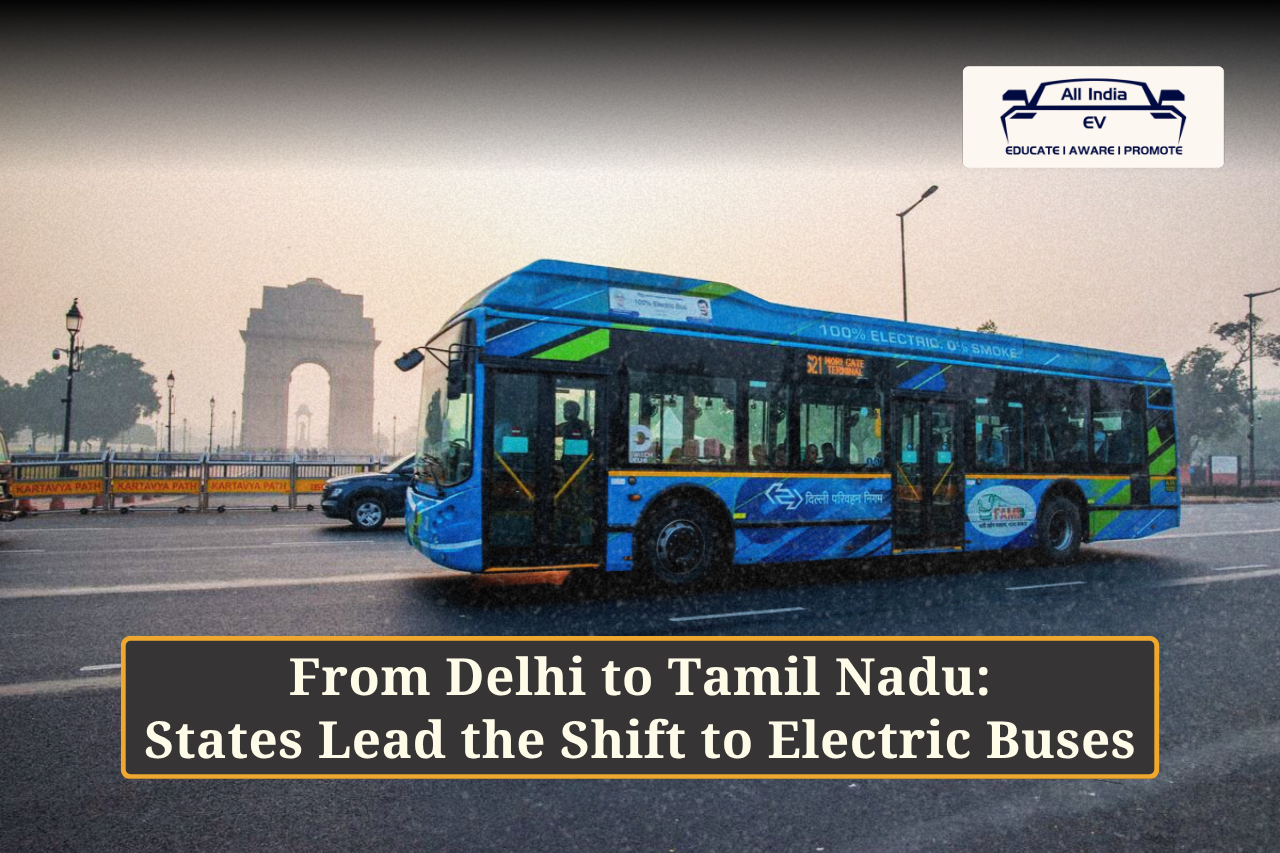

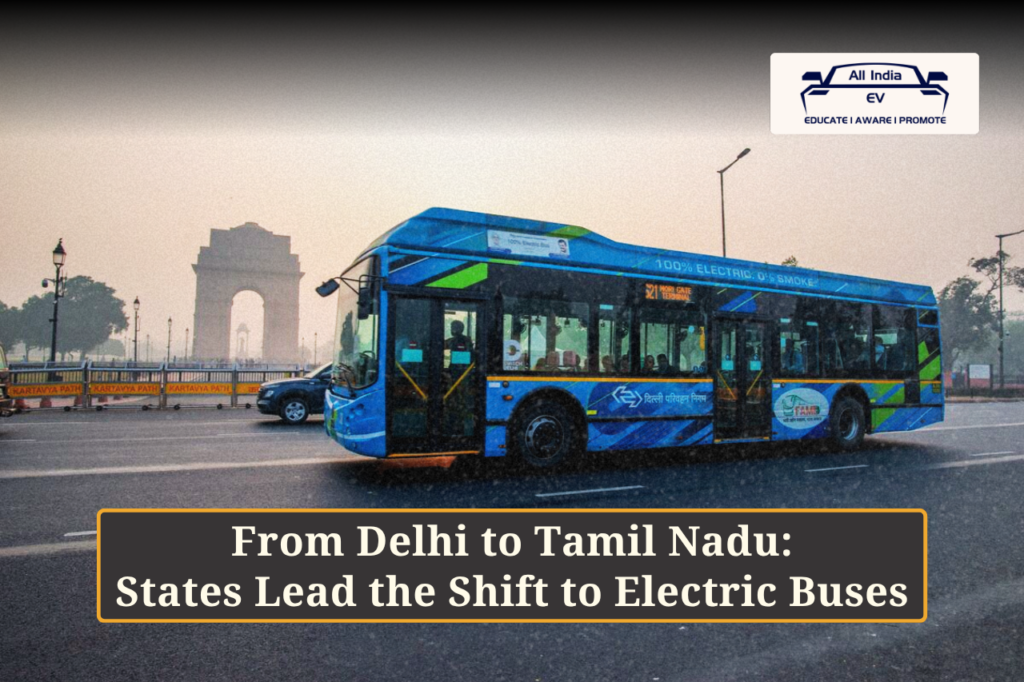

Govt Pushes Public Transport Electrification as India’s E-Bus Market Rebounds with Delhi Leading

India’s electric bus (e-bus) market has seen a notable rebound in the first half of FY26 (April–September), with total e-bus sales rising 37% to 2,241 units, up from 1,635 during the same period last year. The resurgence comes as the government intensifies efforts to electrify public transport and reduce vehicular emissions, even as demand for e-buses has been inconsistent across states.

Among states, Delhi emerged as the leader, with e-bus sales jumping 69% to 938 units, compared with 555 units in the same period last year. Maharashtra’s sales rose 48% to 665 units, while Tamil Nadu recorded a remarkable increase to 251 units from just 5 units. Odisha’s sales quadrupled to 125 e-buses, up from 31 previously. Despite this growth, e-buses are currently deployed mostly for urban commutes and select intercity routes, with adoption uneven across the country.

The average price of an e-bus is around ₹1 crore, and under the PM E-Drive scheme, manufacturers can claim a subsidy of ₹25–35 lakh per bus, provided localisation criteria are met.

Policy and Infrastructure Drive

A critical factor influencing e-bus adoption is the availability of charging infrastructure. India had roughly 29,200 public charging stations as of August 2025, according to government data. Charger-to-bus ratios are vital for successful electrification. Experts note that countries with advanced bus electrification, like China, maintain a ratio of ~1:3, while in India, it ranges from 1:8 to 1:12, underscoring the need for accelerated infrastructure rollout.

The PM E-Drive scheme aims to reduce the upfront costs of deploying over 72,000 public charging stations nationwide. For intercity travel, the government is also facilitating e-bus deployment on key highway corridors, including Delhi-Jaipur, Delhi-Agra, Delhi-Chandigarh, and Mumbai-Pune, with incentives for procurement and operations.

Industry insights highlight that northern corridors like Delhi-Dehradun, Delhi-Chandigarh, Delhi-Agra, and Delhi-Jaipur have seen the highest e-bus deployment, supported by adequate charging infrastructure. In southern regions, routes like Hyderabad-Vijayawada and Chennai-Pondicherry are emerging as early adopters. For longer routes, faster charging technologies will be crucial to meet passenger expectations and ensure operational efficiency.

The running cost of an e-bus is approximately 15% lower than diesel counterparts, though cost-effectiveness improves significantly at scale.

Government Support and Funding

The government has allocated about 40% of the ₹10,900-crore PM E-Drive scheme—around ₹4,391 crore—to reduce the upfront costs of approximately 14,000 e-buses. A primary tranche of 10,900 buses will be tendered by Convergence Energy Services Ltd for Delhi, Hyderabad, Ahmedabad, Surat, and Bengaluru.

To address persistent localisation challenges, the government tweaked PM E-Drive guidelines on 30 September, allowing manufacturers importing rare-earth magnet-based traction motors to retain incentives. Under the PLI-Auto scheme, only three domestic manufacturers—Tata Motors, Volvo Eicher, and EKA Mobility—currently meet localisation and investment criteria.

Adoption Trends and Global Comparisons

Despite growth, India’s e-bus penetration remains low, at roughly 7% of total buses sold, compared with 14% in Europe and 50% in China. NITI Aayog has recommended introducing e-buses in five cities and creating a blended fund to lower the cost of capital for procurement.

Experts emphasize that robust infrastructure, financial incentives, and policy clarity are key to scaling e-bus adoption. The integration of charging stations at bus depots, urban corridors, and highways, combined with strategic deployment of buses, will be central to achieving India’s electric mobility goals.With increased government focus, subsidy support, and infrastructure rollout, India’s e-bus market is poised to grow steadily, with Delhi leading, followed by Maharashtra, Tamil Nadu, and Odisha as early adopters of clean public transport.