Is India’s EV Industry a Rental Dream, Made in China, or Assembled in India?

The Indian EV industry is standing at a fascinating yet fragile crossroad — powered by rising aspirations, policy ambition, and market momentum, but constrained by technological dependencies and supply chain bottlenecks.

- Is India’s EV Industry a Rental Dream, Made in China, or Assembled in India?

- ⚙️ Current Reality: Assembled in India, Powered by China

- 🚲 Is Indian EV Industry Just a “Rental Dream”?

- 🧩 Made in China or Assembled in India?

- 🏭 The Path Forward: From “Assembled in India” to “Engineered in India”

- A Dream Assembled, Not Yet Engineered

As the debate heats up, one question surfaces repeatedly:

Is India’s EV dream merely a rental economy fantasy, made in China and just assembled on Indian soil?

The answer — like the industry itself — is not binary, but a blend of truth, transition, and untapped potential.

⚙️ Current Reality: Assembled in India, Powered by China

Let’s be brutally honest. The vast majority of EVs on Indian roads today are not “Made in India” in the truest sense. They are assembled in India using critical components imported from China and other East Asian economies.

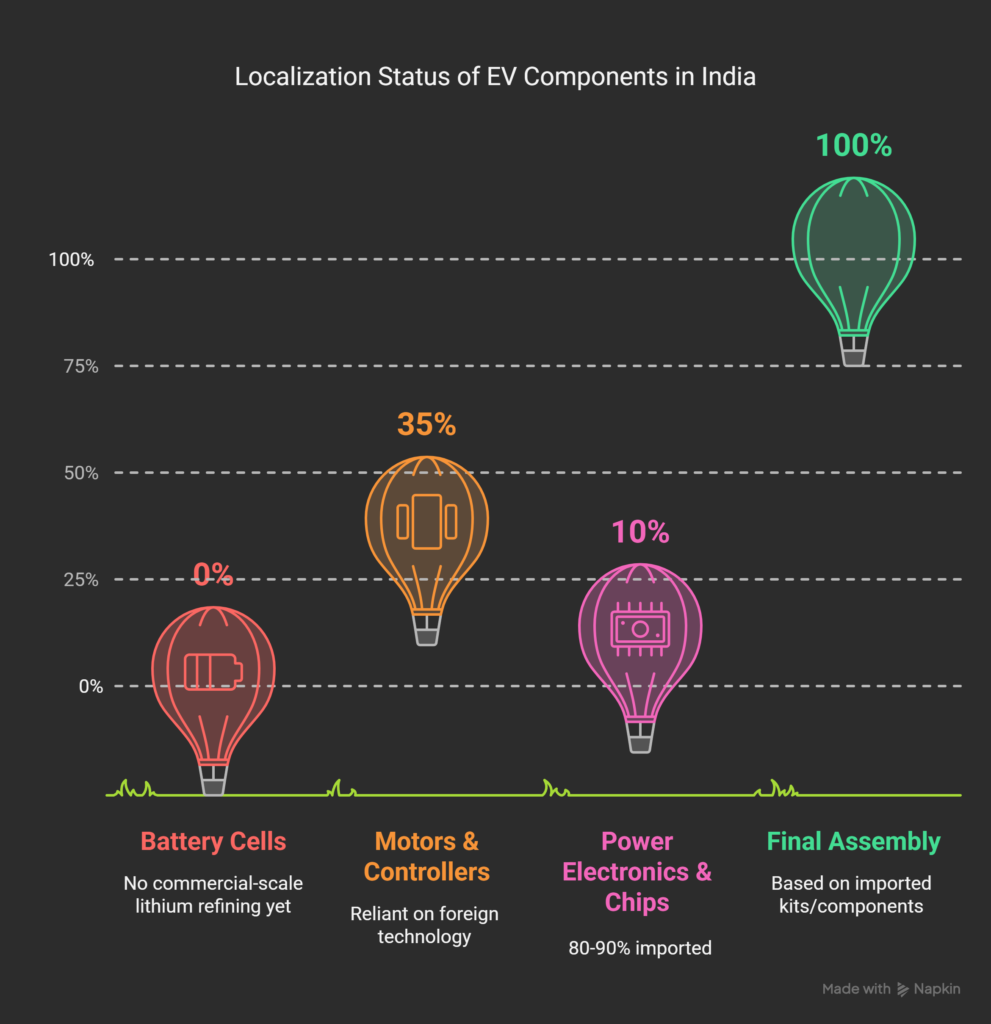

🔍 Here’s what the data shows:

- Battery Cells: Over 90% are imported, largely from China, South Korea, and Japan. India lacks the mining or refining infrastructure for lithium, cobalt, or nickel.

- Traction Motors & Controllers: Only 30-40% localized. Many are still based on Chinese or European designs .

- Power Electronics & Semiconductors: Mostly imported; India has limited capacity to manufacture EV-grade chips or high-performance PCBs .

- Assembly: Carried out in India, but mostly from SKD/CKD kits or with imported sub-assemblies .

As one PwC report puts it — “India’s EV ecosystem is a screwdriver economy — assembling the dreams, but not owning them yet.”

🚲 Is Indian EV Industry Just a “Rental Dream”?

The rental and commercial fleet segment is undeniably the backbone of current EV adoption in India:

- Delivery companies like Zomato, Zepto, Swiggy, Blinkit, and Amazon are heavily reliant on low-speed EVs and battery swapping models.

- Cities like Delhi, Bengaluru, and Hyderabad have seen a surge in daily battery swaps — over 150,000 per day by companies like Yuma, Battery Smart, and Bounce.

But this growth is incentive-sensitive and fragile:

- Post the reduction in FAME II subsidies, the rental EV segment saw a sharp decline in demand.

- Private consumer adoption is still modest, with total EV penetration at under 6% of all new vehicle sales.

Without consistent policy support and local manufacturing push, the “rental-led EV revolution” may end up as a temporary sprint — not a marathon.

🧩 Made in China or Assembled in India?

Let’s break it down:

Component Status

- Battery Cells Imported; no commercial-scale lithium refining in India yet

- Motors & Controllers~30-40% localized; still reliant on foreign tech

- Power Electronics & Chips80–90% imported

- Final Assembly Done in India, but based on imported kits/components

- Technology Ownership Largely foreign; Indian firms often license or partner with Chinese firms.

Even companies like Ola Electric, Ather, Tata, and Hero are assembling EVs, but often using a mix of local and imported parts, with very limited core tech developed indigenously.

🏭 The Path Forward: From “Assembled in India” to “Engineered in India”

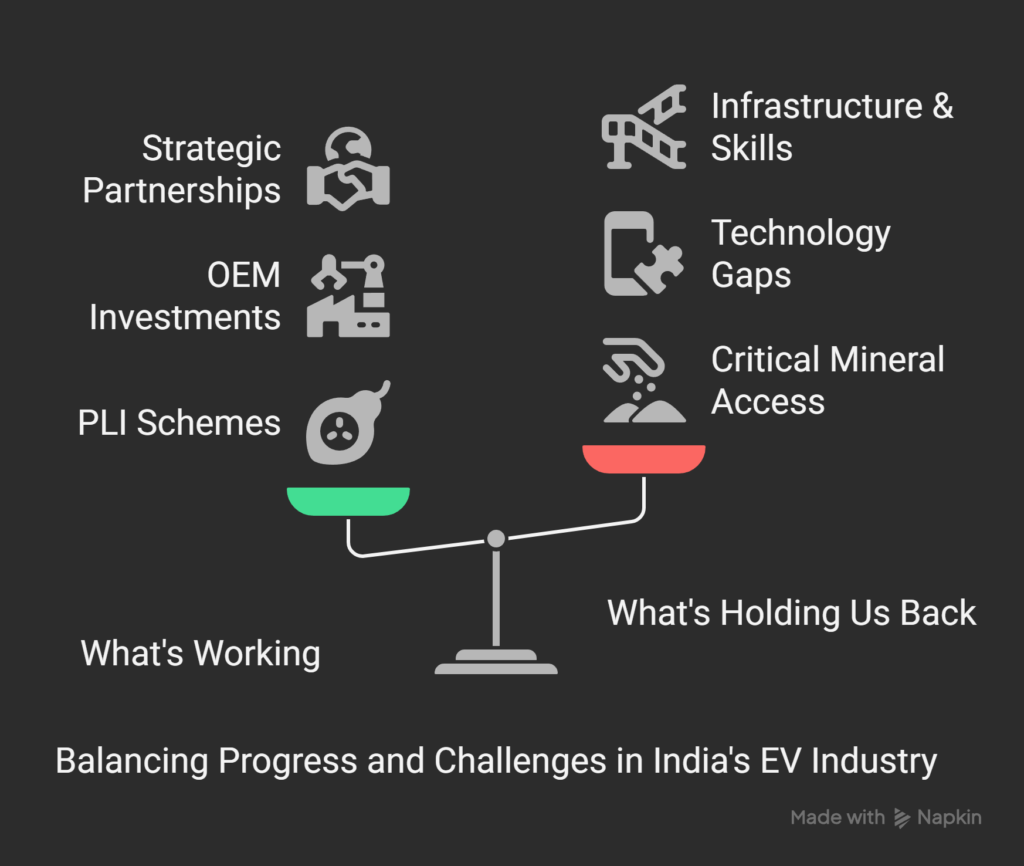

✅ What’s Working:

- PLI Schemes: ₹18,100 Cr for ACC battery storage, plus incentives for EVs and component makers

- OEM Investments: Companies like Exide, Amara Raja, Ola, and Log9 are setting up cell giga factories, though most will be operational only by 2026 .

- Strategic Partnerships: Indian firms are collaborating globally — for instance, Uno Minda and Tata Motors’ tie-ups with Chinese and Korean tech players.

❌ What’s Holding Us Back:

- Critical Mineral Access: India still lacks mining rights or refining capacity for lithium, cobalt, etc. Most raw material value is captured overseas

- Technology Gaps: EV-grade power semiconductors, motor design, battery chemistry — still heavily reliant on foreign IP .

- Infrastructure & Skills: India needs better testing labs, skilled talent, and deeper R&D to scale domestic capabilities

A Dream Assembled, Not Yet Engineered

India’s EV story so far is more about ambition than autonomy. While the vision of a “Made in India” EV ecosystem is loud and clear, the present reality is this:

🚗 “Assembled in India, Powered by Chinese Cells, Driven by Rental Models.”

But this is not a failure — it’s a transition.

With the right policy direction, deeper localization, and sustained investment in tech, India can shift from being an EV assembler to becoming a global EV innovator.

🧾 All India EV Note:

The road is long, but not impossible. India doesn’t just need to drive electric — it needs to own the battery, write the code, and design the motor.

Join us on Substack: https://allindiaev.substack.com/