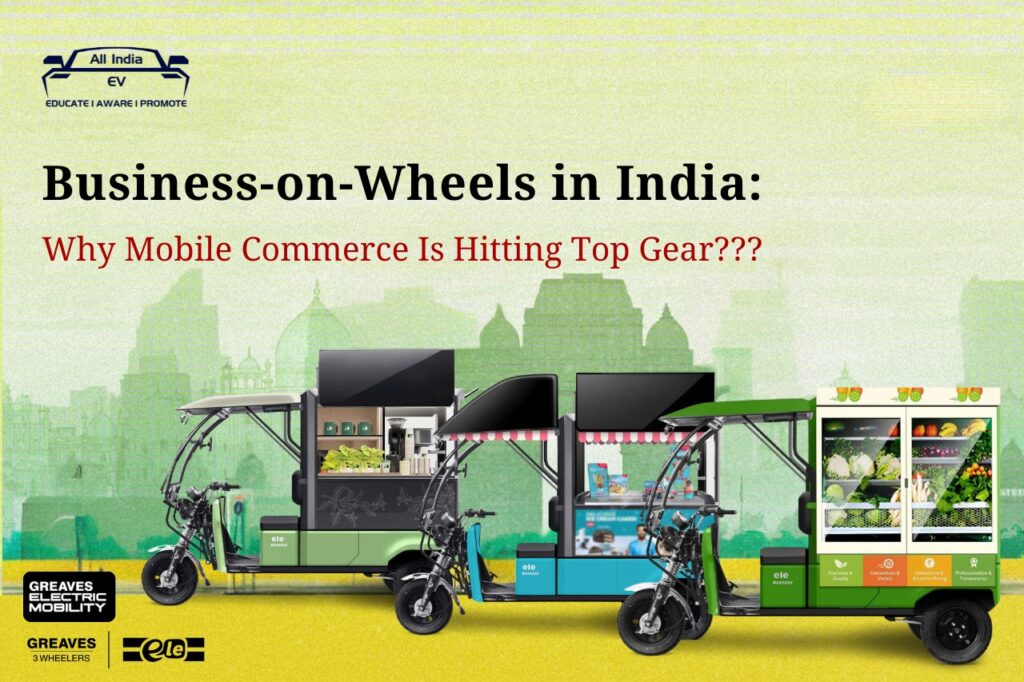

India’s “business-on-wheels” model—customized vehicles that sell food, retail goods, or services on the move—is exploding across cities and small towns. Electric three-wheelers (E3Ws) and compact e-LCVs are doing the heavy lifting, making last-mile commerce cleaner, cheaper, and easier to formalize. In July 2025, EVs captured 37.2% of passenger L5 3-wheelers and 21.2% of cargo L5 3-wheelers sold—clear proof that the mobile-business backbone is electrifying rapidly.

What Is ‘Business on Wheel’?

A mobile business uses a customized vehicle (3-wheeler, van, mini-truck, or rickshaw) fitted with purpose-built fixtures—display racks, chillers, deep-freezers, sinks, espresso machines, storage cabinets, pet-grooming tables, even mini diagnostic labs—to sell or serve on designated routes or pop-up locations. Think vegetable carts with chillers, ice-cream rickshaws with deep-freeze, coffee vans, or mobile grooming salons—either single owners or fleet-run.

Why It’s Growing So Fast

1) Lower Entry Barriers

No long leases or giant deposits. Vehicle + fit-out financing is more accessible than classic storefronts, thanks to EV-focused lenders. The PM-SVANidhi micro-credit scheme has been extended to March 31, 2030 with a ₹7,332-crore outlay; as of July 30, 2025 it has disbursed 96 lakh+ loans (₹13,797 crore) to 68 lakh vendors—serious fuel for low-capex entrepreneurship.

2) Flexibility & Reach

Mobile units can test multiple neighborhoods, run late hours, and pivot offerings quickly. Cities are formalizing space via night food markets and clean/plastic-free street-food hubs (e.g., Delhi’s NDMC-area proposal inspired by Indore’s 56 Dukan; Kolkata’s new Russel Street hub).

3) Last-Mile Delivery, Now Electric

Electric 3Ws and e-LCVs dominate intra-city logistics due to low running cost and policy tailwinds. Example: Mahindra Treo Zor advertises ~₹0.11/km running cost—music to any TCO spreadsheet. Independent 2025 research finds EV 3-wheelers already cheaper on total cost of ownership than ICE (EV ~₹1.28/km, vs. CNG ~₹2.35, diesel ~₹2.69, petrol ~₹3.21).

4) Digital Payments & Discovery

UPI processed 19.47 billion transactions worth ~₹25.08 lakh crore in July 2025, making QR payments universal for micro-merchants. Meanwhile, ONDC has 7 lakh+ sellers onboarded and reach across 1,200+ cities—a discovery channel mobile vendors can tap beyond curbside footfall.

Platforms, Products & Correct Specs (so your deck is precise)

- Greaves Electric Mobility (3W): Refer to Greaves’ ELE (e-rickshaw/loader family) and the newer Eltra cargo line rather than “ELE-eKart.” The cargo-oriented Xargo (3-wheeler) is typically ~300 kg payload—ideal for produce carts or light frozen kiosks; ELE models are ICAT-approved.

- Euler Motors (3W): Flagship cargo 3W is HiLoad EV (not “Storm”). Certified payload: 688 kg; real-world range: 110+ km; AC charge 3.5–4 h; DC top-up ~50 km in ~15 min.

- Switch Mobility (e-LCV): IeV4 payload ~1.7 tonnes, ~120–130 km range—great when fit-out weight is high (full kitchen, sinks, diagnostics).

- Tata Ace EV (mini-truck): ARAI range ~154–161 km, payload up to 1,000 kg, and claimed running cost ~₹1/km (Ace EV 1000 brochure).

What You Can Put on Wheels (Today)

- Food trucks/carts & dessert kiosks (coffee, ice-cream, chaat, bakery)

- Fresh produce with display racks + chillers

- Meat/dairy/frozen sellers with spill-proof, partitioned freezers

- Pet-grooming salons and mobile retail

- Diagnostics/test vans and pharmacy pop-ups (where permitted)

Customization is now off-the-shelf: Greaves’ cargo/passenger E3Ws and specialists like Azimuth Business on Wheels supply tailored, ICAT-compliant builds with warranties and food-grade surfaces.

Compliance & Safety (non-negotiable cheat-sheet)

- Street Vendors Act, 2014: Operate under a Town Vending Committee; obtain a Certificate of Vending to avoid encroachment penalties and hassles.

- FSSAI (for any food business):

- Hot food ≥ 65 °C, cold food ≤ 5 °C, frozen ≤ −18 °C—build these into SOP stickers on board.

- FoSTaC training is strongly recommended; 3,00,000+ street vendors trained to date.

- Battery & EV safety: Ensure vehicles meet AIS-156 traction-battery norms (Phase-1 from Dec 1, 2022; Phase-2 from Mar 31, 2023). Ask for compliance documents from your vendor/upfitter.

Ops & Uptime: Charging, Swapping, and Powering Aux Loads

- Swapping networks keep E3Ws moving between peaks: Battery Smart has 1,400+ swap stations across 35+ cities; SUN Mobility operates 900+ swap points across 23+ cities (and is scaling via an IOCL JV). This is clutch for coffee vans or cold-chain carts with high utilization.

- Aux power for refrigeration/espresso: Use a separate auxiliary battery (or DC-DC) for chillers and hot plates to protect traction range; add temperature logging and IP-rated enclosures. Anchor your HACCP plan to the FSSAI temperature limits above.

Money Talk: TCO & Financing Pathways

- Running cost: Cargo 3W EVs like Treo Zor advertise ~₹0.11/km; 2025 TCO studies show EV 3Ws are the lowest-cost option in Indian cities (EV ~₹1.28/km vs fossil alternatives).

- Credit access: Beyond PM-SVANidhi (numbers above), multiple NBFCs and OEM-linked financiers now underwrite E3Ws and fit-outs, improving approval rates for thin-file borrowers.

- Collections & sales: UPI QR for instant payments; ONDC for discovery outside your daily route.

Urban Policy Momentum

Cities are actively carving out organized vending zones and night food markets (Delhi), while the Clean Street Food Hub program certifies hygienic clusters—249 certified hubs nationwide as of July 6, 2025. Kolkata’s new plastic-free street-food hub shows how city branding and hygiene can lift vendor incomes and consumer trust.

Risks & How to Mitigate

- Battery replacement (3–5 years, usage-dependent): amortize in pricing; prefer clear battery warranties (e.g., 5–7 years on some platforms).

- Charging access: plan swap-first in dense cities; keep an energy budget for aux loads (refrigeration/espresso).

- Licensing clarity: keep vending + FSSAI docs on board; display license QR; operate within designated zones to avoid penalties.

- Insurance: carry third-party + public liability, product liability (for food), and worker coverage.

Mini Buyer’s Guide (quick matches)

- Light food cart / coffee van (espresso + cold drinks):

- Platform: E3W (Greaves Eltra cargo / Euler HiLoad).

- Why: low capex; city maneuverability; fast-swap options available.

- Full kitchen or diagnostic van (heavier fit-outs, sinks, gensets):

- Platform: e-LCV (Switch IeV4) or Tata Ace EV.

- Why: payload headroom and electrical capacity.

Moving forward

Business-on-wheels blends entrepreneurial agility with hard TCO math, digital payments, and formalization. With EV-first platforms from Greaves, Euler, Tata, and Switch; city-level vending reforms; PM-SVANidhi finance; and UPI/ONDC expanding demand capture, this model is set to redefine how India eats, shops, and gets services—on the curb, on-demand, and on-wheels.